Growth sector stocks were the price winners through the COVID-19 crisis. Those companies with a good prospect of future growth in profits from emerging technologies, with little in the way of tangible assets.

What has been of concern is that many of these companies now have astronomical valuations and even if the growth comes through as expected, there is little margin for error. They trade on a multiple of sales, not a multiple of earnings, because many of them have little or no earnings.

In addition, capital flows have been such that a lot of the buying has come from price agnostic investors. In America, Cathie Wood and the ARK series of ETF’s were lauded as celebrities. But that now appears to be rapidly turning sour. Ms Wood admitted recently that Bill Hwang was an integral part of seeding the ARK ETF’s when they got started in 2014. (if you don’t know Bill Hwang and Archegos Capital please give it a Google). That symbiotic relationship may come under regulatory scrutiny in future, but one thing is for sure, in late March 2021 when the major US brokers realized how much leverage Bill Hwang had amassed by using swap contracts, it was the beginning of the end. Instead of an orderly liquidation, Goldman Sachs wanted to hit the exits first, resulting in a bloodbath for many of the growth names held by both Hwang and the ARK ETF’s.

We are now seeing these growth stocks on a different trajectory, and if maintained, it could lead to years of disappointment, with lower prices begetting lower prices. The traders that helped bid these things up have short attention spans, so a year without profit is sure to lead to further liquidations, perpetuating the reversal of fortunes.

The last 12 months has looked very much like the tech bubble, but as I have said before, it is hard to know if we are in the equivalent of 1998, or early 2000. In spite of that it is worth considering what was the best place to be in the period that followed the bubble. Value stocks had taken a pummeling in the period leading up to the Tech Bubble top in March 2000. However, in the 8 years that followed, Value outperformed by a wide margin. The other thing that happened was that Active outperformed Passive as the more discerning capital allocators had a huge advantage in not being forced to own rubbish, just because it was part of an ‘index’.

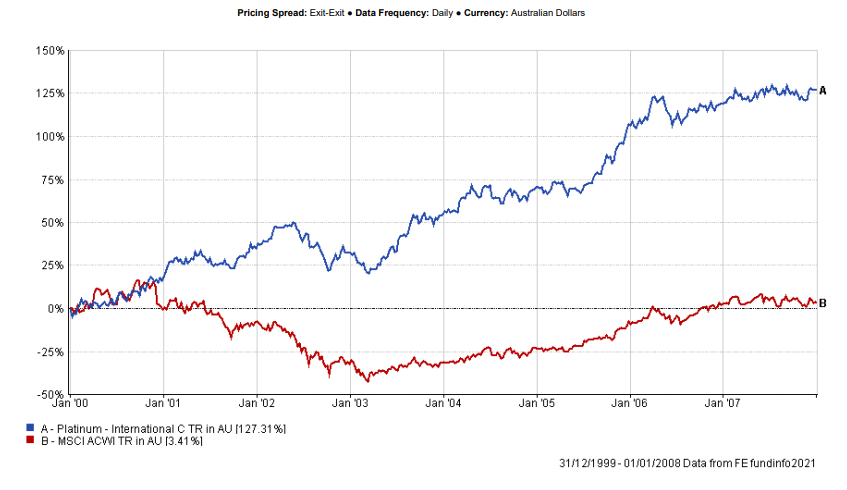

Figure 1. Platinum International vs MSCI World Index from 1 January 2000.

As can be seen in the chart above, when stocks are expensive, you can have a lost decade. This is when active management becomes important, because you can still make a good return in spite of overall weak indexes. Not that Platinum is, or was, a pure Value manager, they are more of a Thematic manager with a strong valuation discipline.

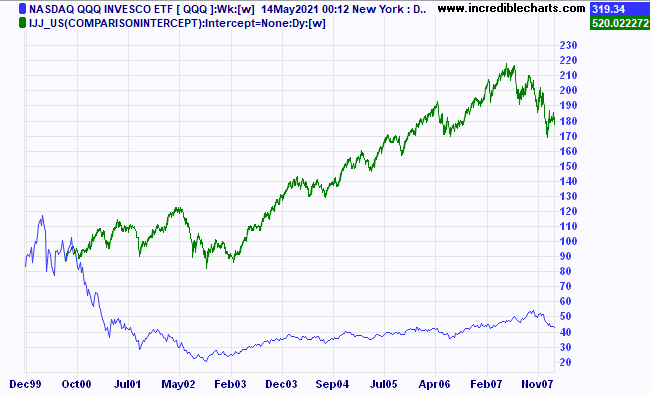

A better comparison may be the Nasdaq 100 ETF versus the MidCap US Value factor ETF.

Figure 2. Nasdaq ETF from 1/1/2000 with intercept of US MidCap Value ETF from August 2000.

The vast difference in performance here shows that even when parts of the market are wildly overvalued, the un-loved and under-owned sectors can still provide strong returns. Given that market timing with any degree of accuracy is quite difficult, rather than stepping out of equities altogether, it makes sense to retain exposure that is not so overvalued.

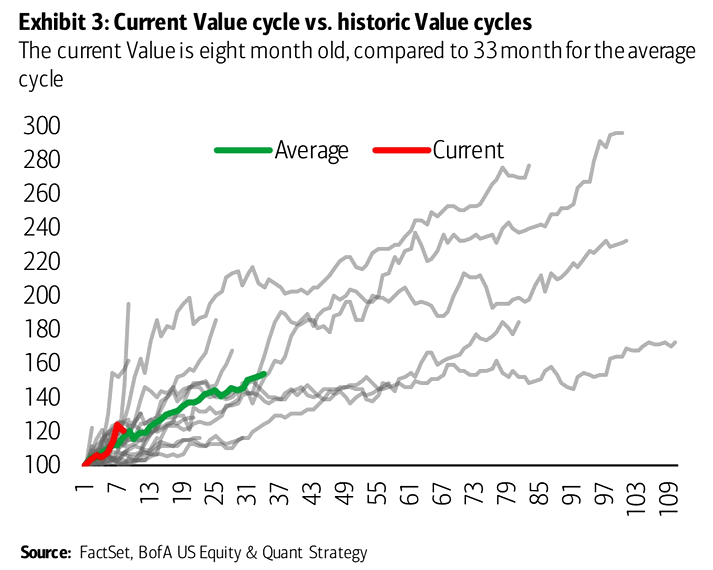

Figure 3. Magnitude of Value outperformance factor during a typical cycle.

Figure 3. above looks at how persistent the performance is once the shift from Growth to Value gets underway. The chart shows that we are only 8 months into a cycle that typically runs for 33 months on average and has been known on occasion to run for 9 years.

The lesson for us is that recency bias can lead us into traps that are difficult to escape. We tend to believe that what has happened in the recent past will continue. By being aware of past cycles, and recognizing that within a market there are many underlying different currents, we can position ourselves to retain some equity market upside, without putting capital at un-necessary risk.

Though we are not a nation of hockey players, I’m sure you can visualize what the father of the great Wayne Gretzky told him in Junior hockey. “Go to where the puck is going, not where it has been”.