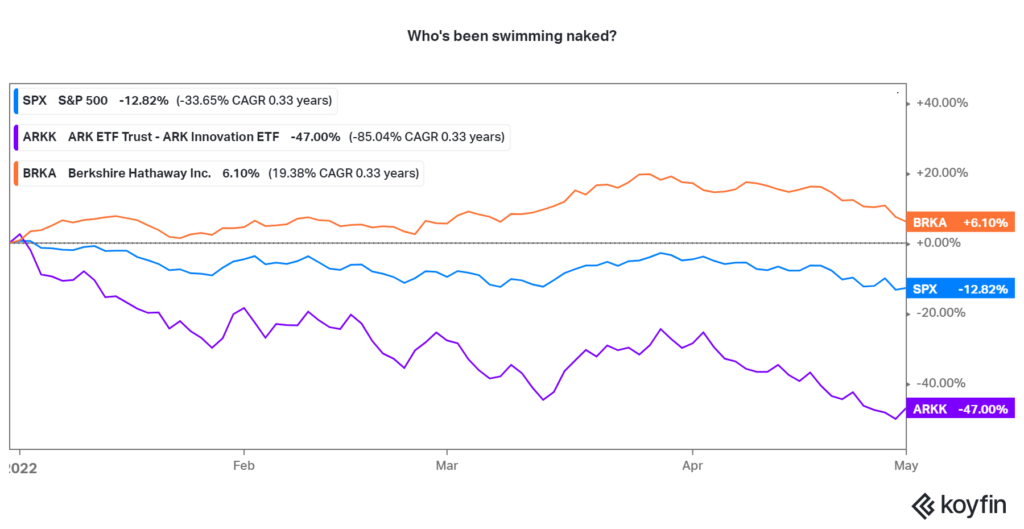

Warren Buffett’s famous quote, ‘only when the tide goes out do you discover who was swimming naked’ is very prescient for todays markets.

With the onset of interest rate rises, and tightening of fiscal conditions, non-profitable growth companies have been falling rapidly. I have now observed three cycles when Warren Buffett has been labeled as a washed up has-been who doesn’t ‘get’ the current crop of ‘growth’ investments. Right now, Warren is having the last laugh, and may we keep his memory strong, because it is unlikely that he will still be around at the top of the next bubble.

Now that the tide has turned, we thought it would be good to check the attire of the swimmers.

In spite of the sell-off since January, Mr Buffet still has his boardies firmly tied around his waist. The S&P500 index, well, maybe we could say the budgie smugglers are somewhat askew. As for the pin-up girl of ‘tech innovation’ Cathy Wood and the ARK Innovation fund, -47% tells only half the story. Since the peak in ‘un-profitable growth’ back in February 2021, that fund is down 72%. Swimmers – gone!

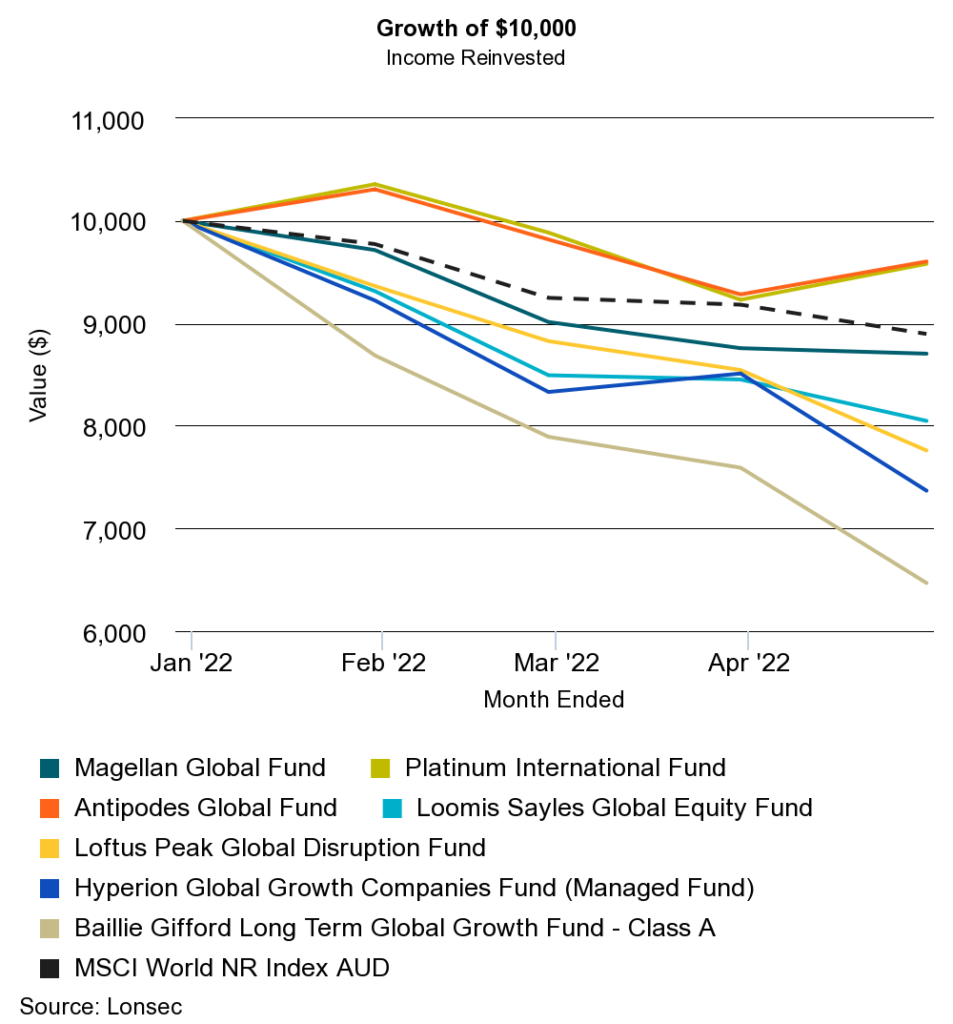

Global Managed funds – Australia

Here in Australia, we check the swimming attire of some of the popular global managed funds.

As we would hope and expect, some of the value managers have done well considering the poor market conditions.

Antipodes Global -3.9%, Platinum International -4.2% are examples. The benchmark is the MSCI World Index -11.1%. Slightly behind the index is Magellan Global -12.9%, and with more ‘growthy’ stocks is Loomis Sayles Global Equity at -19.5%.

Others that had great returns over the last few years, but which had valuations too bubbly for us to invest in are:

Loftus Peak Global Disruption -22.4% (not owned by our clients)

Hyperion Global Growth -26.3% (not owned by our clients)

Baillie Gifford Long Term Growth -35.31% (not owned by our clients)

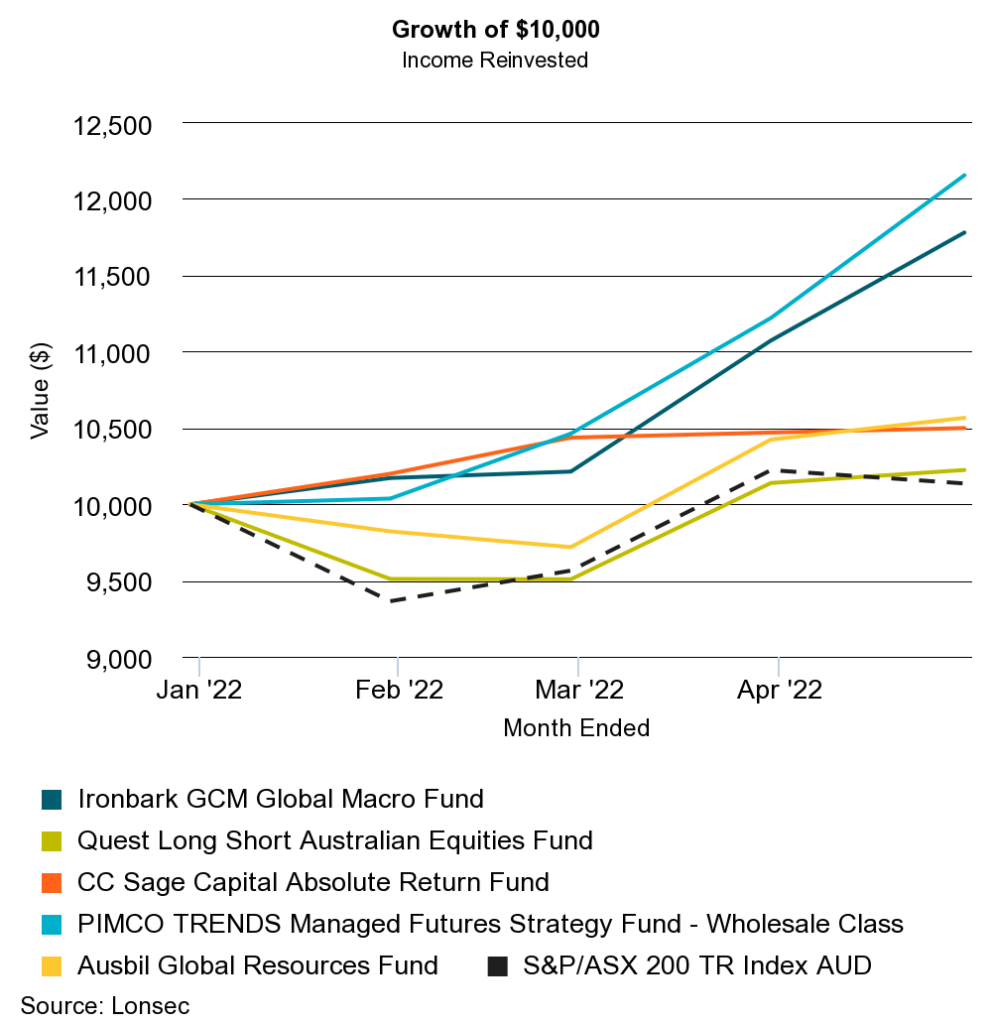

Alternative Assets – Fully Clothed

Some of the common holdings in our portfolios in the ‘hedge fund’ space have made out very well, and others have certainly added good value.

Pimco Global Trends was up 21.5%. Ironbark GCM Global Macro up 17.8%. The Ausbil Global Resources fund, which is also able to ‘short sell’ was up 5.7%.

You may have heard us talking a lot more about “Equity Market Neutral” funds recently, and the CC Sage Absolute Return Fund is one example, up 5.0% in the last four months. Another that we have been doing some work on is the Quest Long Short Australian Equity which was up 2.3% since 1 January.

Alternative assets are sometimes hard to understand. But as seen above, in this market, where both shares and bonds are lower, they can add a lot of value in smoothing out portfolio returns.

We will be bringing some more perspectives soon on how far out the tide is likely to go. If you would like to hear more about any of the funds we mention here, or how they can fit in your portfolio please let us know!

Great article