Most of my readers know I am apolitical and sceptical rather than cynical.

I am not convinced that the ‘science’ on climate really is ‘settled’.

I do agree that the less pollutants we release into the atmosphere the better off the planet will be. But I can also see that many ‘solutions’ are politically expedient and fail to contemplate the massive task to truly reduce emissions without compromising life as we now know it.

Having set out the philosophical position, lets do what everyone else does, and ask, “What’s in it for me?”

TAX SAVINGS

Yes, thanks to some legislation passed late in 2022, you can now legally escape that pesky fringe benefits tax on private motor vehicle use. But there is a time limit to act, and given the long wait times for certain vehicles, you need to get your ducks lined up.

Both full Electric Vehicles (EV’s) and Plug-In Hybrid Elective Vehicles (PHEV’s) can now be provided to an employee with no fringe benefits tax. That is a huge personal tax saving.

Currently, for an internal combustion engine (ICE) vehicle, the most effective way to salary package is via what’s called the Employee Contribution Method. This is where you pay 20% per annum of the vehicle value (purchase price) from your post tax earnings, and the balance is from pre-tax dollars.

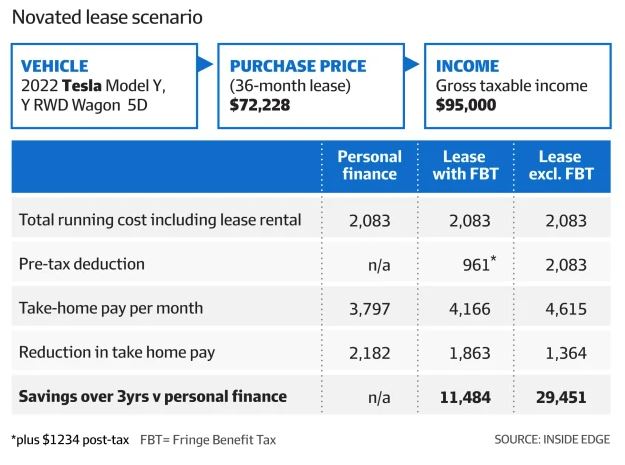

On a $72,228 vehicle, the savings versus no packaging is worth about $3,828 per annum.

However, with the Fringe Benefits Tax Exemption on EV’s and PHEV’s the savings using the same vehicle value could be $9,817 per annum. In other words, no GST (that is claimed back by the employer and savings passed to you) and no personal tax on the money that is going towards the payments on the vehicle! Bring it ON!

This table below, from Inside Edge, shows the savings in three different scenarios for a full EV (Tesla) but the figures are the same for a PHEV.

What’s the catch?

Well, the price of the vehicle must be below the Luxury Car Tax Limit for Fuel Efficient vehicles. This year 2023/24) that figure is $89,332. If the car was first sold in the 2022/23 year, the LCT was $84,916. (So if you are thinking of a second hand car, it must have never been sold for more than the LCT in the year it was first sold)

There is another catch. For PHEV’s the vehicle needs to be purchased and in use before 1 April 2025. The Fringe Benefits Tax Exemption will continue until the end of the financially binding commitment to provide private use of the vehicle. So if you are leasing, make it a five year lease.

What kind of Plug In Hybrids are available?

The Alfa Romeo Tonale comes to mind. But with a price right at the top of the LCT threshold your head might win out over your heart. More practical is the Ford Escape, with demo models around $50,000 to $55,000, the full price is $61,000. The Mazda CX-60 is around $86,000. If you don’t mind Chinese cars, the MG HS Plus SUV is around $50,000. Mitsubishi Eclipse Cross is around $50,000.

I am a bit surprised that we haven’t seen more hoopla around this nice little tax break. It can be even more beneficial if you sell your old car and pay off some non-deductible home loan debt.

Definitely worth looking into if you own a company or are an employee.

Talk to your accountant to make sure you have crossed the t’s, dotted the i’s and the lower case j’s.