Much has been written in the last few weeks about the travails of Hamish Douglass and Magellan Financial Group. Adding to the run of recent underperformance of the funds they manage, came the resignation of the CEO, Brett Cairns on December 6th, and then on December the 8th an ASX announcement that confirmed the rumours that Hamish and his wife Alexandra had separated. Further, confirming that bad news travels in ‘threes’ it was announced on 20 December that St James Place, a large UK wealth manager had terminated a contract with Magellan, representing 12% of Magellan Financial Group annual income. Hamish Douglass will be glad to see the back of 2021!

What do we make of it, and are there any urgent actions?

It is important at the outset to understand the different investments mentioned here and in the media.

- The operating business which earns fees from managed funds is ASX listed; Code is MFG

- The main unlisted managed fund – which is how most retail clients invest; Code MGE0001AU

- Then there is the ASX listed, closed end fund, which holds most of the same investments as the un-listed managed fund; The ASX Code is MGF

There are also listed and unlisted High Conviction funds, and the new Core Series which offer a lower management fee. We will focus on MFG, MGE0001AU and MGF.

MFG is the operating business. It earns the fees from the assets that it manages. In recent times it announced the purchase of 10% of Guzman y Gomez for $86 million. Hamish must really like Mexican cooking! Then there are the foray’s into Finclear, Airlie Funds Management, and Barrenjoey Capital Partners. The latter is an investment banking business with fairly cyclical earnings. Guzman, FInclear and Barrenjoey don’t have much synergy to the business of managing global shares. At least the tie up with Airlie Funds management, a fund manager headed by John Sevior, does have some direct synergy benefits. All of this corporate wrangling must have some impact on the ability of a Chief Investment Officer to make good decisions.

Since the peak of MFG at $74.91 in February 2020, and then a lower peak of $66 in August 2020, the company shares are down by 73.3% to $19.98 on 23 December 2021. Most brokers have cut their targets, with Macquarie Equites at a $20.00, twelve month price target. Back in June they were at a $47.50 price target. A better call was made by Bill Keenan at Bluebird Portfolios. He removed MFG from the stock portfolios in March and June 2021 at prices above $45.17. Bill now says that the stock may be oversold and will investigate a point at which the downside becomes negligible.

The flagship retail fund on which the Magellan reputation was built is the MGE0001AU. It was established in late 2007, and nicely sidestepped the huge GFC sell-off.

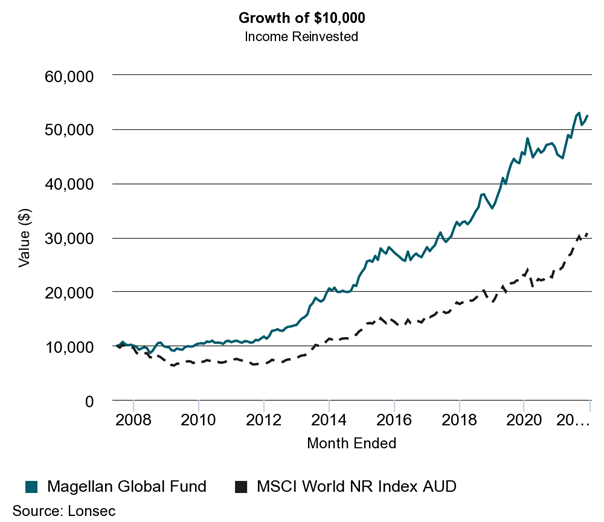

Total return since inception (according to our Lonsec data) is 424.21%.

By way of comparison the MSCI World Net Return index in AUD returned 208.18%.

Figure 1: Magellan Global Fund long term

The reputation is well deserved.

What about recent returns? As they say, ‘one day a rooster, next day a feather duster’.

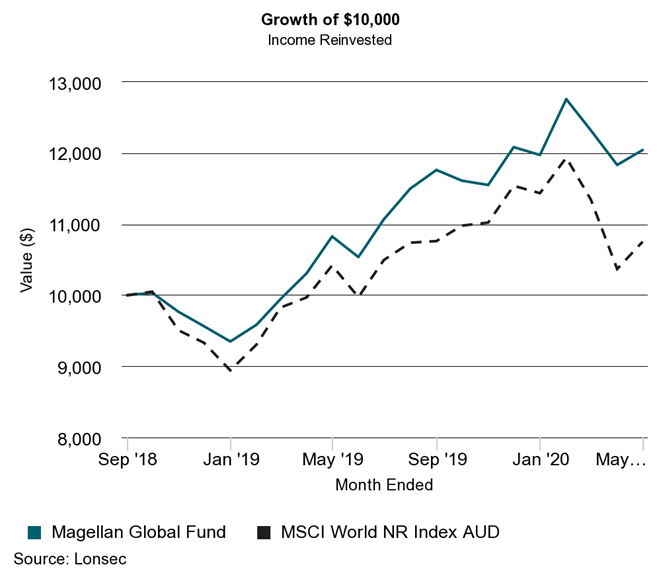

From 30 August, 2018 to 30 April 2020 markets had two big sell-offs, the kind that Magellan has often protected us from. The October to December 2018 ‘taper tantrum’ when the US Federal Reserve signaled a tightening in rates, and again in March 2020 with the COVID-19 sell-off.

As Figure 2 shows, that nineteen month period was also one in which Magellan protected in the downturns, and performed when things were going well.

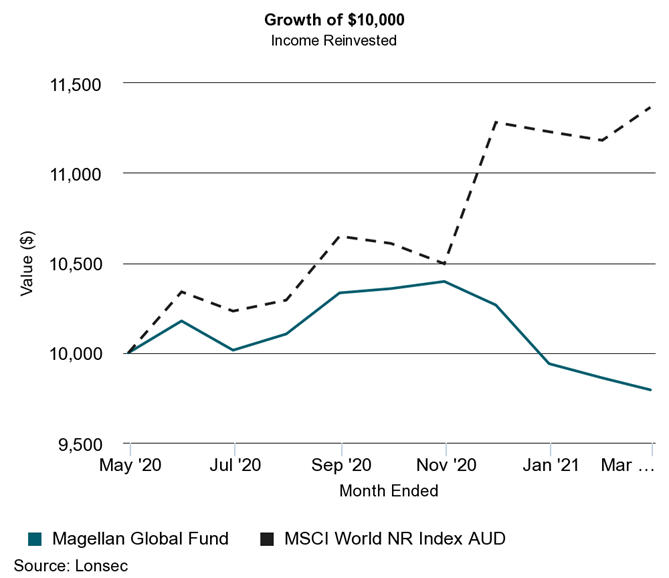

So, where is the poor performance that resulted in the recent underperformance? The real damage to the Magellan performance came in the period from the end of April 2020 to February 2021. Figure 3 below shows that MGE0001AU was down 2.00%, while the MSCI was up 13.64%

Quite simply, Magellan got it wrong for about 10 months and that is where all the current attention is focused.

Holding some Chinese internet giants like Alibaba and Tencent, and also having an overly pessimistic view of the potential ongoing risks of COVID-19 hurt the returns in that period.

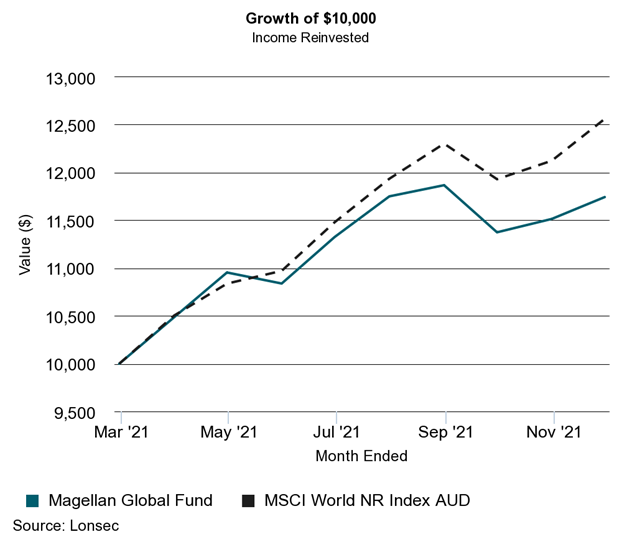

Since February 2021, the performance has continued to trail the benchmark, although by a lesser margin. The Magellan Global fund is up by 17.43% versus the MSCI index gain of 25.61%. (Figure 4)

The conclusion on the managed fund is that we see no compelling reason to move quickly on any changes. We continue to assess the alternatives, but a short period of underperformance does not by itself necessitate a change. There are some lower cost active global fund that are in our buy list, and we may make a replacement at review time.

MGF – The closed end Magellan Global Fund. This is a closed end fund, (like a Listed Investment Company) which trades on the ASX. This structure can trade at a premium or a discount to the underlying net asset value. At present (22/12/2021) the MGF is trading at $1.71. The net asset value per unit is $2.07. That means that the units are trading at a discount of 17.3% to the net asset backing. On this basis alone, we would not be selling. If an investor is looking to increase international exposure to large cap quality companies like Microsoft, Google, Facebook, Netflix, Visa and so-on, then this could be used as a buying opportunity for the patient investor.

Sadly, there is a vicious cycle to funds management success. When you are smaller and smarter that is the time you have the greatest chance of outperforming. As you become successful, more and more people are throwing money at you. As the amount of money you manage grows the original edge is harder to maintain. When you have achieved success there are the hungry wolves that would love to see you fall. The recent underperformance has certainly brought out the wolves. Periods of underperformance are hard to predict when they start and when they will end. We certainly have no issue with the investment selection process that Magellan has used in the past. Warren Buffett, arguably the worlds most recognized investment personality has experienced had patches of underperformance. We don’t see this period for Hamish Douglass as being too different. He may even come out of it humbled and hungry to rebuild his reputation.