One thing that has intrigued me over the years is how we (humans) make judgements on what is a good investment given how we see things at face value.

This trait manifests itself in chasing trends. We see real-estate going up, we get interested in how to get on board. We see the trend to de-carbonisation and we think about lithium producers.

However, early in my career I heard the saying, “If it’s obvious – it’s obviously wrong”.

That warning makes me reluctant to jump onboard something that seems too obvious on the surface. Sometimes that has been to my detriment. Being too cautious and too contrarian, and thinking an investment trend was too ‘obvious’.

It is often the case that unless one has specialist industry insight, by the time a trend becomes that obvious, the low hanging fruit has already been picked.

The fact that we are two years into the COVID-19 pandemic made me think about what would have happened if we had some special inside knowledge of the pandemic back in December 2019. If we knew we were in for a two or three year pandemic, and that in 2022 politicians would be doing sales calls for the drug companies talking up the benefits of a third and fourth booster shot.

You could be forgiven for assuming that with such fore-knowledge you would be making squillions.

AstraZenica (AZN) and Pfizer (PFE) must be making out like bandits!

Well, you know me, I love to look at the numbers, so let’s have dig into it.

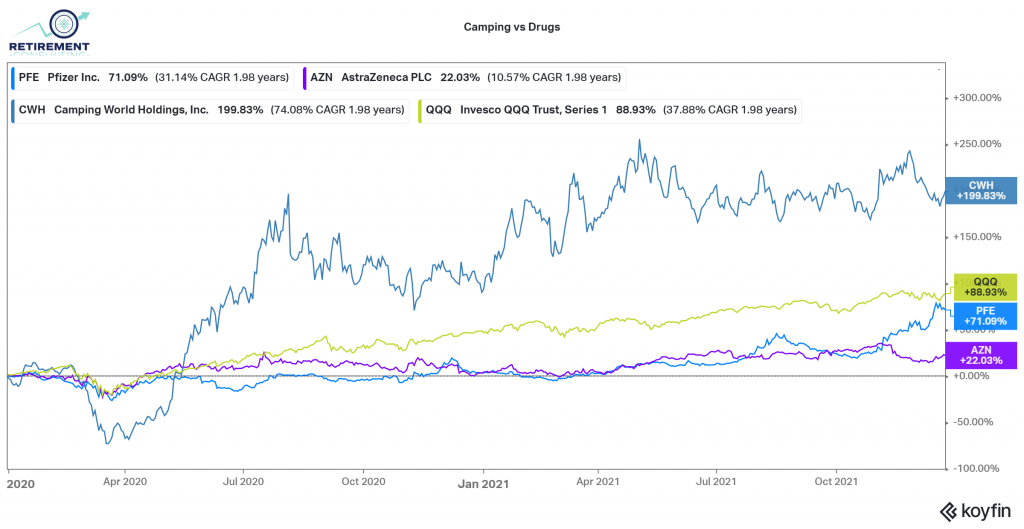

In chart 1 below, you will be surprised to find that, from December 31, 2019 to today, you would be better off having invested in the NASDAQ index, than investing in either Pfizer or AstraZenica, the two most widely promoted vaccines. AZN is up a mere 22.03% since then, and PFE is up 71.09%

By contrast, the QQQ (Invesco Nasdaq 100 ETF) is up 88.93%. (the green line)

Yes, “If it’s obvious – it’s obviously wrong”

In fact, the secondary effects of this pandemic has been a return to nature, and Camping World Holdings (the blue line) is up by almost 200%. A good reason to look beyond the obvious (drug makers) and try to find those secondary beneficiaries.

Actually, there is more data to add to this story.

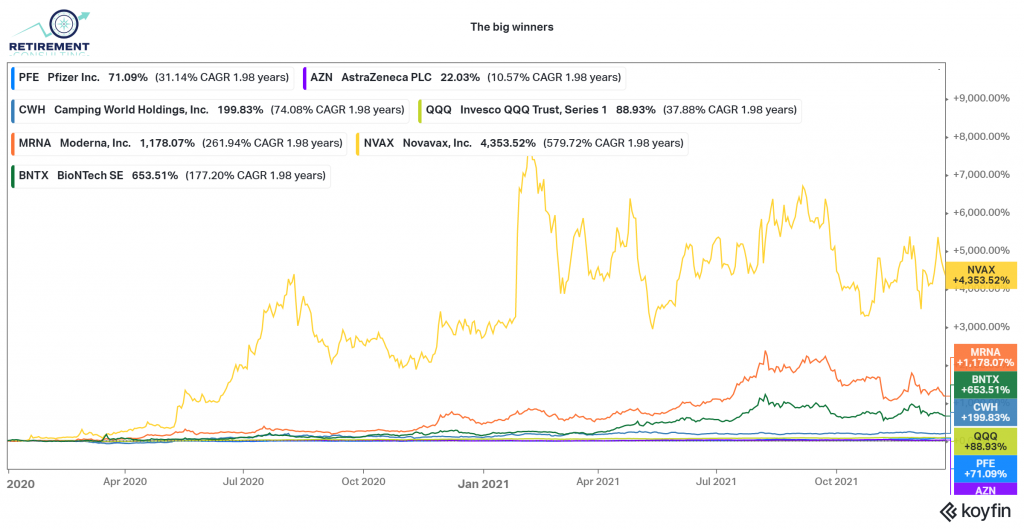

There are other, smaller drug makers who have benefited greatly. AZN and PFE were already big companies. Smaller drug makers received a much bigger benefit in proportion to their existing size.

In chart 2, we add BioNtech (BNTX) Moderna (MRNA) and Novavax (NVAX) to the chart.

As you can see, Novavax was the big winner, up a massive 4,353%. That turned $10,000 into $435,000 over two years.

This is a good reason why, unless you have exceptional specialist knowledge in a field, it is often best to take a portfolio approach to widen your net and increase the chances of success.

Back to the question at the outset? If we knew the future, would we be better investors? Possibly not, and even if we do have some insight; portfolio construction and risk management are equally important ingredients in consistent long term investing success.

I loved this analysis. I have been in the financial services industry for years and I will admit without dissecting facts as per your analysis above I was buying into the narrative that drug companies must all be cleaning up. As you have shown this is not necessarily the case across the board. Interestingly Novavax is or was the subject of a shareholder led class action due to shareholder losses sustained as a result o f manufacturing delays and ‘over promising and under delivering’ https://finance.yahoo.com/news/novavax-inc-nasdaq-nvax-shareholder-183000138.html .

Regardless of things looking bad for Novavax which may have stopped someone investing look at them now – approved for emergency use by WHO, The European regulators and approved or being considered in many other markets.

I totally agree with the conclusion ‘ portfolio construction and risk management are equally important ingredients in consistent long term investing success’.

Great post, keep them coming ….