How often have you walked along a beach like this one, and found yourself asking that question?

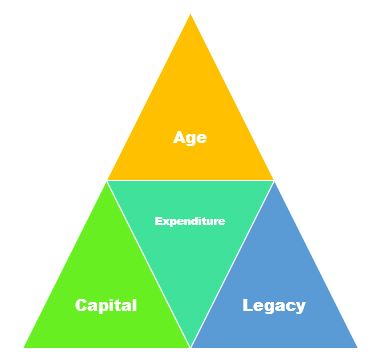

Unfortunately, there is no single magical number that answers the question. The answer is multi-dimensional and will be different for almost every person. I describe this as the ‘triangle of tension’ where we need to have decent answers to some of these factors before we can answer the question.

- What Age will you retire?

- What is your targeted retirement Expenditure?

- How much Capital do you have now?

- What Legacy do you expect to leave behind?

To set the tone for this conversation lets make some observations on each of the four points above.

Retirement Age

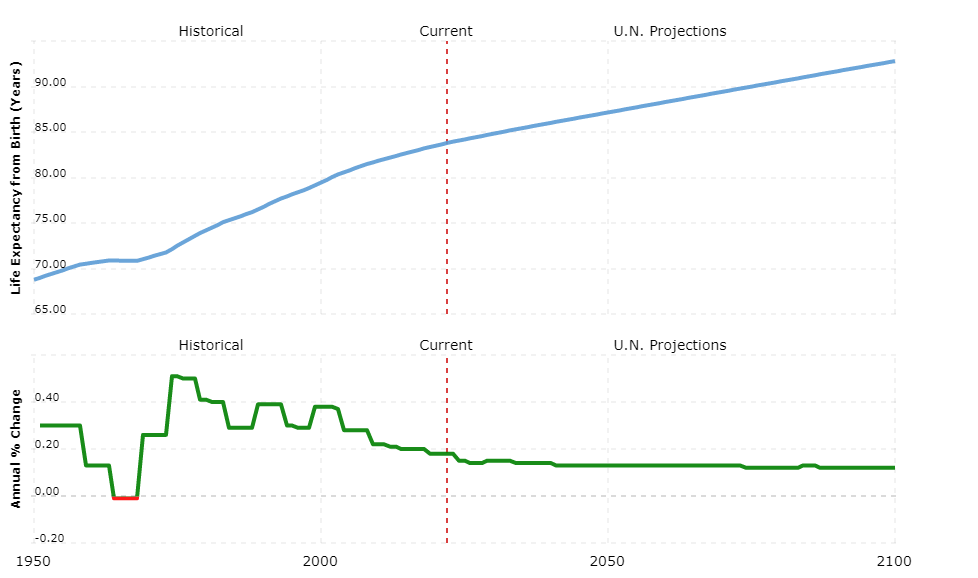

Official retirement age for most Australians in the 20th century was 65. As recently as 1970, average life expectancy was 71.21 years. Today, according to Macro Trends analysis of UN data, the average life expectancy in Australia is 83.79. So we have gone from a period of funding about 7 years of retirement, to funding at least 19 years of retirement, and quite likely more than that to be on the safe side. Many of my 84 year old relatives and clients are alive and kicking!

https://www.macrotrends.net/countries/AUS/australia/life-expectancy

If Centrelink age pension age is the main trigger for retirement, then age 67 is going to be a common point at which people are thinking of retirement. You can see why expectation of retirement age is such a big factor in answering the question, ‘how much is enough?’

What is your Expenditure Expectation?

Expenditure is the next big swing factor. The Association of Superannuation Funds of Australia (ASFA) have an quarterly survey of retirees. They divide their survey responses into two buckets, “Comfortable Lifestyle” and “Modest Lifestyle”. The descriptions are fairly self explanatory, but you can get more information about what that means here https://www.superannuation.asn.au/resources/retirement-standard

The survey says the average couple describing themselves as having Comfortable Retirement lifestyle spend $64,771 per annum. (these are homeowners – no mortgage). Those couples identifying as Modest, spend $41,929 per annum. Single life is cheaper, with $43,193 being Comfortable, and $27,286 being Modest.

Your own expectations of retirement expenditure will have a big impact on answering the question, ‘how much is enough?’

Capital – How much do you have?

A lot of people know how much they have in super. Some have an expectation of how much they might receive as an inheritance from parents (or rich spinster aunts and uncles!). But not too many consider the equity in their own home as potentially part of their retirement capital.

Understanding all the sources of capital available to you is important in planning for your retirement. If you have no children, and live in a $1,000,000 un-encumbered home, there is a source of retirement income sitting all around you. Reverse mortgages and the Centrelink Home Equity Access Scheme are two ways of tapping some gradual drawdown of your accumulated wealth that may not be immediately obvious to you. (we will discuss this in more detail in a future blog).

The time you have between now and retirement, and your income less expenses is a big determinant of how much additional capital you can accrue between now and retirement. Will you use gearing? Have you got some ‘carry forward contributions’ allowance that can help you save tax? Can you improve your rate of return without taking too much risk?

Capital is the core of this question, ‘how much do I need to retire?’ but as we have seen, there are ways to make more of what you have in order to meet your goals.

Legacy – What do you want to leave behind?

Many people become totally stressed by holding the belief that they have accumulated capital of ‘X’ and therefore they must leave at least that amount of capital or more behind when they ‘shuffle off this mortal coil’. If you have a great expectation of receiving a large inheritance from your parents, then it is understandable that you might expect to be able to do the same. But while this is an admirable position to take, in my experience (good) children do not put the same emphasis on large capital legacies as parents do.

As a result, the lament in recent times has been; “I’ve got a million dollars, but even at 1% interest rate, that only earns me $10,000 per year!” Stepping it up a notch, four million dollars at 1% interest is only going to earn you $40,000 a year, not even enough to meet the ASFA Comfortable Lifestyle standard for a couple!

But that is where the mindset around maintaining capital comes in. If you have $4,000,000 is it necessary to leave the whole nest egg behind? Same goes for $1,000,000.

In recent times there has been a quiet revolution in what is called Comprehensive Income Products for Retirement (CIPR’s) Every superannuation fund after 1 July 2022 must have a position and solution for what is becoming known as ‘decumulation’. While it doesn’t dictate that a superfund must have a lifetime annuity option, it is quietly steering them all in that direction. Whether this is the start of a slippery slope where all super must be taken as an income stream remains to be seen, but the general consensus in the hallways of power are that large superfunds are better. This may indicate a future intent to have the largest possible pool of longevity risk pool within four or five mega funds, which puts them in a better position to offer lifetime income streams.

What about just answering the QUESTION! (How much is enough?)

OK, back to that question.

Let’s have a look at a couple, they hit age 67 and have $1,000,000 in super. Congratulations. But guess what. No age pension for you! No. In Australia, unlike New Zealand, we have a means test for age pensions. If you are a home owner, and your assets (excluding the home) exceed $901,500 (as at 22 March 2022) then there is no pension for you. Thanks for working hard, paying tax, and contributing to your country, have a nice retirement. (The maximum age pension for a couple in Australia is $38,708 per annum. Every dollar that you have over $405,000 reduces the combined pension rate by $3.00 per fortnight).

What are the odds that the $1,000,000 can generate $64,771 per annum from age 67 to age 84 to give you a ‘Comfortable’ retirement? To answer that we turn to the Milliman Smartshield calculator. This is a stochastic backtester of portfolio probabilities. The backtest indicates you have a 62% chance of success with a Growth portfolio, and a 51% chance with a Balanced portfolio. The average balance left at age 84 would be $277,000 with a growth portfolio. Milliman have the tools to allow us to also simulate another GFC, and in that backtest the result is that you only have a 4% chance of meeting your income target, and having money left over.

That does not mean $1,000,000 is not enough.

The Centrelink Put

If you have been on this blog for very long, you will know we track a lot of what is going on in financial markets. In recent years, there has been a saying, ‘the Fed Put’. What it basically implies is that the Federal Reserve in the USA will do whatever it takes to support investment markets. A ‘put option’ when purchased, gives you potential to profit when markets fall. It is a roundabout way of saying, the Federal Reserve has my back.

In this case, Centrelink will ride to your rescue with additional retirement income as your assets decline in value. Once you are under that $901,500 threshold (for homeowner couples) then the Australian government gives you some income via Centrelink. Because of this factor, retirement calculators that don’t take into account any available Centrelink entitlement are next to useless.

Once you get below the assets threshold, you get $3.00 per fortnight for every $1,000 below the threshold. So if your assets are down to $801,500 then you will be getting $300 per fortnight in age pension. At $405,000 you would likely be getting a full age pension. Drawing down $20,000 per annum for 20 years, even with no growth, would give you an income of $58,708 per annum, with part of that indexed to inflation, so maybe starting with $400,000 is enough for you.

What can we do to be smarter about investment products and asset choices?

Most portfolios include some fixed interest as a counterbalance to their equities portfolio. Balanced portfolios may be around 60% growth assets (shares, property etc) and 40% defensive fixed income. Growth portfolios more like 80/20.

The concessions granted by to lifetime income streams under social security regulations since 1 July 2019 have created some interesting opportunities. If we were to consider the Annuity as the ‘fixed income component of our portfolio, and retain the balance in a higher risk Account Based Pension (ABP), there is an opportunity to retain access to most of our capital, but at the same time guarantee a comfortable level of income above the age pension.

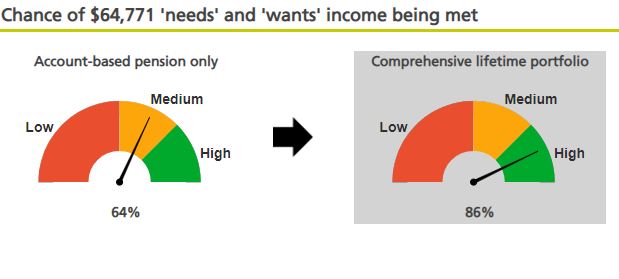

In the charts below we have the outputs from the Challenger Retirement Illustrator which looks at a home owner couple with $1,000,000 in a balanced superannuation portfolio at retirement age 67, and compares the outcome to them putting $300,000 of that super into a lifetime income stream and retaining $700,000 in an ABP.

For Centrelink asset test purposes only 60% of the purchase price of the annuity is counted. So that gets their overall assets down to $880,000 which means they are eligible for $2,085 of age pension from the outset.

They go from having a Medium chance of meeting their retirement income goals to having a High chance of achieving that $64,771 income target.

Additionally, by taking this bucketing strategy of separating their growth and defensive assets, they gain a lot more peace of mind that regardless of investment markets they can get $14,625 of annual income in addition to any age pension entitlements.

Products for lifetime income

This is not a product placement for Challenger. We used their tool for this illustration because they have done a lot of work in this space over many years, and it happens that their calculators are very good at visualising very complex outcomes.

Other products lifetime annuity solutions are coming to market regularly, including some ‘with profit’ annuities. Q Super (now merged with Sunsuper to form Australian Retirement Trust) has products in this space. The Milliman SmartShield also has a mechanical asset protection fund that allows investors to increase risk and potential return, while also protecting against downside risk. No doubt more of these lifetime products will come to market soon as each superfund complies with the Retirement Income Covenant.

How much do YOU need to retire?

You are an individual. You may have champagne tastes. Or, you may envision retirement life spent living in the back of a Kombi and surfing every day. You may have a valuable home that can be a source of additional retirement income. Those variables will make the figure unique to YOU.

Hopefully this article has helped you to see that the answer for everyone is different. The answer could be $300,000 or it could be $2,000,000. That all depends on what is important to you.

Understanding the options and variables helps you with making sound decisions about when is the right time to retire and how to balance living the life you want now with final legacies to family or charities.

When you talk to us about your situation, having a prior understanding of these issues will make the discussions we have so much more meaningful. Please give us some feedback in the comments section about other retirement issues you would like to see us cover.

Great article! Very unique perspective on retirement income requirements

Great article Mark which really explains the situation in easy to understand language. Looking forward to seeing some more.