US Treasury Bonds have had their worst three-year performance EVER. No time in history have we seen three consecutive years of losses, and at no time has the peak to trough drawdown been so deep.

That’s a great reason to learn all you can about Bonds right now.

Another great reason to dig into the topic is that the current and future YIELD on BONDS has a huge impact on the pricing of every other financial asset.

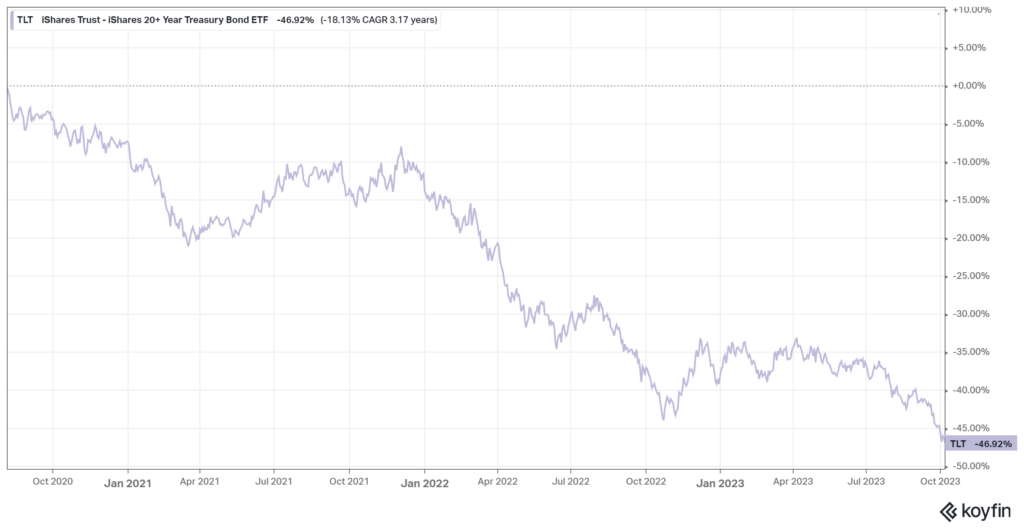

US T Bond performance

I’m going to use an Exchange Traded Fund (ETF) in this first example of just how terrible returns have been for Bonds over the last three years. The ETF with the ticker code TLT is a portfolio of US Treasury Bonds (bonds issued by the US government) that have more than 20 years to maturity.

This government bond ETF is down 46.92% in the last three years. Can you imagine the share market being down that much? That is a GFC magnitude event right there. Yet few people seem to care much about it, and what it might mean.

Right now, the ‘yield’ on a 20 year US Government bond is 5.15% per annum, guaranteed by the might and power of the USA Treasury for the next twenty years.

“Yield” is a way of expressing the total return per annum of a bond if held to maturity. That return consists of regular interest payments (Coupons) as well as any capital gain or loss on your original purchase price.

Only three and a bit years ago that 20 year bond ‘yield’ was a measly 1.1%.

For the last four years we have been avoiding long duration bonds. They represented very poor value and high risk. Although the return of your capital was guaranteed, there was very little return on your capital. And as illustrated in the case of TLT, the ‘mark to market’ change in value can be extreme when rates are as low as they were in 2020.

But maybe the value proposition is about to change!

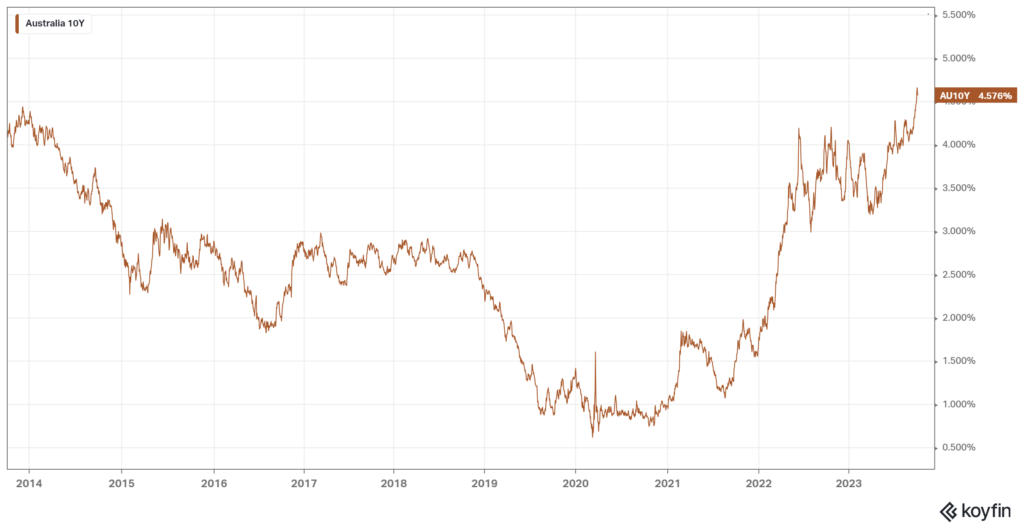

The yield on ten-year Government Bonds in Australia, is now higher than its ever been in the last ten years.

This could be either the opportunity of a lifetime, or maybe the bear market in Bonds has further to run before that opportunity can be realised. Let’s dive in so that we can understand the key terminologies of the bond market.

There are six key concepts in understanding bonds, and I want to take you through each one so that at the end of this you can invest (or not), with a level of knowledge that will likely exceed 99% of the people in any given room.

- Coupon

- Face Value

- Issuer

- Credit Spread

- Duration

- Yield

First up let’s understand the COUPON.

The term Coupon stems back to the old days of ‘Bearer Bonds’. This was when a company or government would issue literal pieces of paper setting out their obligation to repay you a fixed amount at maturity, and fixed interest payments along the way.

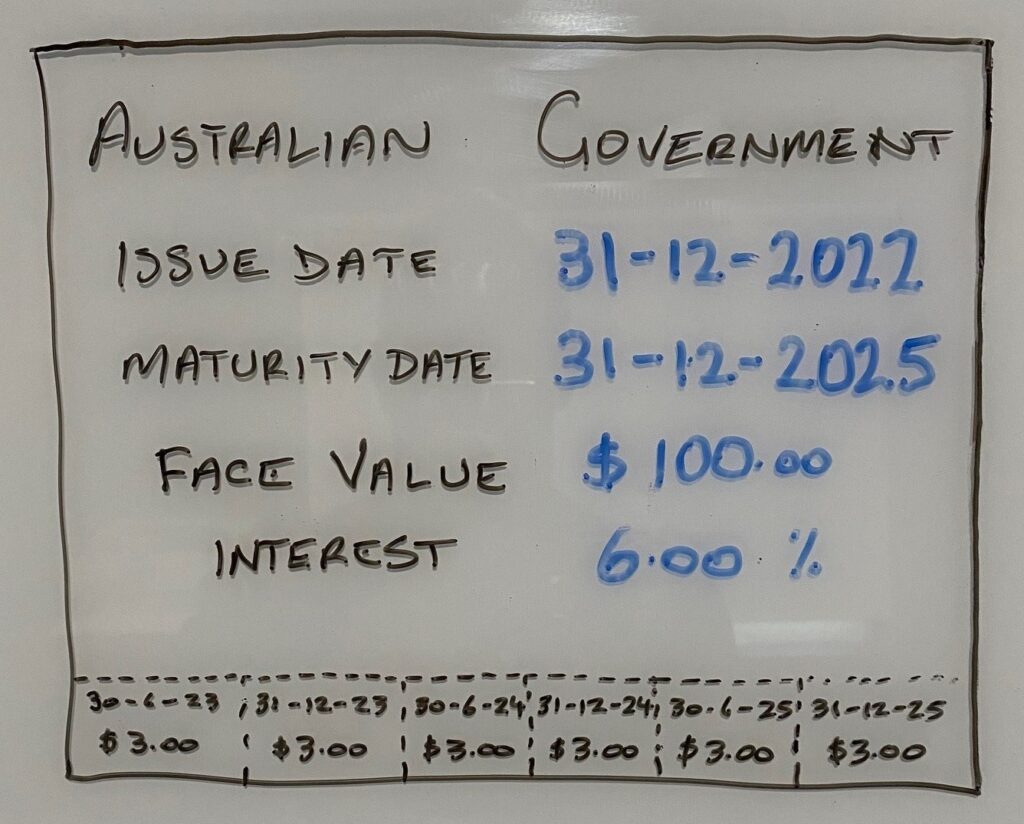

In our whiteboard illustration below we have stylised how a physical bond used to look when they were issued on paper. In this case a three year bond issued by the Australian Government.

At the very bottom you can see a perforated section with six ‘coupons’ of $3.00 each. In the old days, you would go to the bank, tear off a coupon once the due date came up, and swap it for $3.00 in cash. Bearer Bonds bestowed the holder with the ability to carry his or her investment around with them and still be earning interest, unlike a briefcase full of cash. Bonds are no longer issued physically, and all trading and custody is done via large banks and custodians.

Using our example, you can also see there is a FACE VALUE of $100. This is the amount that the issuer will pay you when the bond reaches a fixed maturity date. As you can also see, the maturity date of this bond is 31/12/2025.

The ISSUER is very important. Obviously a bond issued by the Government of a country is going to be highly secure. These are referred to as Sovereign Bonds. Within each country the yield on a Sovereign bond is considered to be the risk free rate of return on investing.

Not all ISSUER’s are equal. Obviously, with a company that has shaky finances, there is some risk that they will not pay the full maturity value when that bond matures. The major ratings agencies, Moody’s, Standard and Poor’s, and Fitch may rate the financial prospects of a company issuing a bond and ascribe a Credit Rating. These ratings may range from AAA (the highest) to D, which is given to a company that is in Default.

Bonds are generally categorised as Investment Grade or Speculative. Investment Grade is AAA down to BBB minus. If your debt is cut to a BB+ rating, then it falls into the Speculative Grade. Bonds that fall from BBB- to BB+ rating are referred to as Fallen Angels. Because many funds and organisations can only hold Investment Grade bonds, the demotion to Speculative Grade often sees these bonds have a big fall in price.

The difference between the YIELD on a Sovereign (government) Bond, and the YIELD on a Company or Semi-Government Bond is referred to as the CREDIT SPREAD.

For example, in the USA, a BBB rated bond has a yield to maturity of 1.59% more than an equivalent maturity Sovereign Bond. Today, (08/10/2023) a five year US Government Treasury bond has a YIELD of 4.75% per annum at present. A five year, BBB rated Corporate Bond with five years to maturity has a current YIELD of 6.34% per annum.

Delving into the Speculative Grade credits, a BB- rated US bond today has a YIELD of 7.85% p.a. An example of a BB- rated bond is Ford Motor Credit Company.

DURATION is another key part of the Bond puzzle. We are going to keep this at the overview level. In simple terms, the DURATION of a Bond is the time left until it matures. In our sample above, of the Australian Government Bond maturing on 31/12/2025, we would say it has 2 ¼ years of Duration. IE; it matures in two and a quarter years.

DURATION matters when the general level of Interest Rates change.

For example, let’s say you buy a two year bond when market interest rates are at 6%. Now imagine that the next day, the market rate of interest on a two year bond surges to 7% because the CPI result came in much higher than expected. You will still get your 6% return (YIELD) over the next two years if you hold that Bond until it matures.

However, because those bonds are also traded every day, you might want to know what is the current market value of your bond if you wanted to sell.

A simple rule of thumb is that the market value changes by 1.00% for every one year of DURATION.

This means that your two year bond might have dropped in value from $100 to only $98 if you wanted to sell.

But what if you locked in that 6% interest rate for 10 years? In simple terms, the bond would fall in value by about 10%. If you want to use a bond yield calculator here is a link: https://dqydj.com/bond-yield-calculator/

So, as you can see, an increase in market yields (or interest rates) means the current market price of a Bond will fall.

Sovereign Bonds are affected by market interest rates, and the longer the Duration the more sensitive they are.

However, Corporate Bonds prices are affected by market interest rates as well as CREDIT SPREADS.

During a Recession, it is expected that Government Bond YIELDS will decrease, (prices rise) but at the same time, it can occur that Credit Spreads increase on a Corporate Bond, especially if issued by a cyclical company.

If CREDIT SPREADS widen by 1.00% it has approximately the same impact on prices as YIELDS going up by 1.00%. And the price impact is exacerbated by the DURATION. IE: if you are invested in a risky bond, then the longer you are exposed to that risk, the more impact on the market value of that bond.

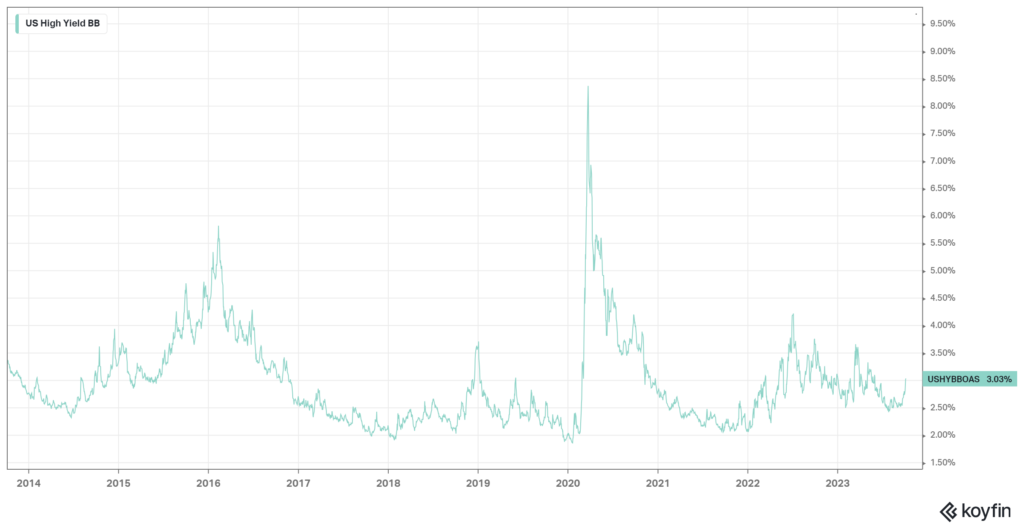

Below I have plotted the Credit Spread on a portfolio of BB rated (highest Speculative Grade) bonds over the last ten years. As you can see, in a crisis, the CREDIT SPREAD widens. In 2020 when the COVID lockdowns hit, the Credit Spread on these bonds blew out to 8.00% above equivalent maturity Sovereign Bonds.

Right now, the CREDIT SPREAD on BB rated bonds is about the middle of the usual 2% to 4% band that they have traded in. However, there is risk that in a recession the Spreads could blow out again, which would cause a temporary loss in value.

I say temporary, because when the crisis passes, the bold buyer of Corporate Bonds can be handsomely rewarded. In the year from 1 April 2020, the BB Corporate Bond index was up 22% in just 12 months.

Right now a portfolio of Investment Grade corporate bonds with 3 to 5 years to maturity is yielding around 6%, which in nominal return terms is quite attractive, especially compared to where we have been in the last ten years.

SUMMARY:

Coupon = Periodic interest payments that a Bond provides while you hold it

Face Value = The dollars you get back on maturity of the Bond

Issuer = The guarantor of interest and principal payments

Credit Spread = The extra return over and above the risk free Government Bond rate

Duration = How long until you get the Face Value back

Yield = The annualised rate of return from today until maturity

Understanding these basics of the Bond Market will prove very valuable in evaluating the risks and opportunities that abound in the bond market right now. It will also help you to understand the upcoming alerts and recommendations that we will be sending in regard to Bonds.