Jim Chalmers has delivered his first Federal Budget, but with many of the policy details having been pre-announced there were not too many surprises.

Please remember the following budget announcement are not yet law.

Reducing the eligibility age for downsizer contributions

The eligibility age to make downsizer contributions into superannuation is set to be reduced from 60 to 55 years of age. All other eligibility criteria will remain unchanged.

This change will provide a boost to the number of individuals eligible to make a one-off, post-tax contribution to their superannuation of up to $300,000, using the sale proceeds of their family home – regardless of their superannuation balance.

Relaxing residency requirements for SMSFs

Previously announced in the 2021/2022 Budget, the residency requirements applicable to SMSFs and small APRA funds were set to be relaxed through:

The extension of the central management and control test “safe harbour” from two to five years, and

The removal of the “active member” test – which would allow members who are temporarily absent from Australia to continue contributing to their SMSF.

Both of these proposals had been slated to commence from 1 July 2022.

The Government has confirmed that these changes, broadly aimed at allowing greater flexibility for SMSF members who are temporarily overseas, are still set to go ahead. However the start date for both measures has been deferred.

Incentivising Pensioners to Downsize

The current Centrelink asset test exemption for proceeds from the sale of a family home, intended for the purchase of a new home, will be extended from 12 months to 24 months

Additionally, for income test purposes, only the lower deeming rate (currently 0.25%) will apply to these exempted proceeds over the 24-month period.

These changes will allow pensioners more time to purchase, build or renovate a new home before their pension is affected.

Increased Commonwealth Seniors Health Card income threshold

The Government has confirmed its commitment to increase the income threshold for Commonwealth Seniors Health Card eligibility from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples.

This change will increase the number of individuals eligible to benefit from a Commonwealth Seniors Health Card.

Freezing of deeming rates

The Government has also confirmed that it will freeze the social security deeming rates at their current levels until 30 June 2024. The lower deeming rate is 0.25% while the upper rate is 2.25%. For singles the upper rate applies to financial assets over $56,400 and for couples it applies to financial assets over $93,600.

For too long the deeming rate was above the rate that a pensioner could comfortably achieve via bank interest, and now it will be held below the rate of bank interest, at least for a little while.

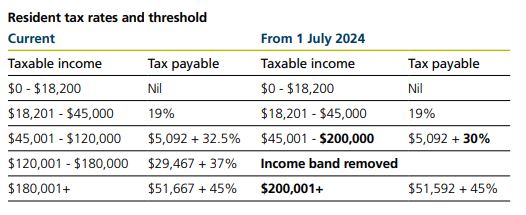

Stage 3 tax cuts to proceed

Despite the ongoing debate about deferring or cancelling the stage 3 tax cuts, the measure will go ahead in accordance with the legislated timetable from 1 July 2024.

The stage 3 tax cuts that were introduced as part of the previous Government’s personal income tax reform, will remove the 37% income band and increase the higher threshold in the 45% income band from $180,000 to $200,000. The applicable rate on the 32.5% income band will also reduce to 30%.

How can we help?

If you have any questions or would like further clarification in regards to any of the above measures outlined in the 2022-23 October Federal Budget, please feel free to give us a call to arrange a time to discuss your particular questions in more detail.

Thanks mark for the up date , we may now be able to apply for the health care card , see you Friday

Bill