In Australia, Exchange Traded Funds (ETF’s) crossed the threshold into a $100 billion pool of investments during the first quarter of 2021.

The milestone was even mentioned in mainstream press where attention was diverted for just a moment away from the daily discussion of COVID vaccine and the death in the Royal family, to the rise in popularity of the simple investing tool of ETF’s. With Vanguard starting a national TV campaign last week the trend is sure to continue.

The majority of the ETF’s provide investors with a market cap weighted exposure to a particular sharemarket. We have posted blog articles about market cap and valuations of the US share market here and here if you would like to brush up your knowledge on those two points.

In the second of those articles on market valuations I mentioned that I would soon be discussing why investors still need to do a lot of homework before choosing an ETF to invest in.

My first point in the article ‘Why I don’t blindly buy ETF’s’ was about valuations. But another risk is that you may not be getting what you think you are getting. The label on an ETF can make it appear as if this is exactly what you have been seeking, but in reality is something different altogether.

This is particularly an issue with the newer branch of the ETF family – Factor ETF’s.

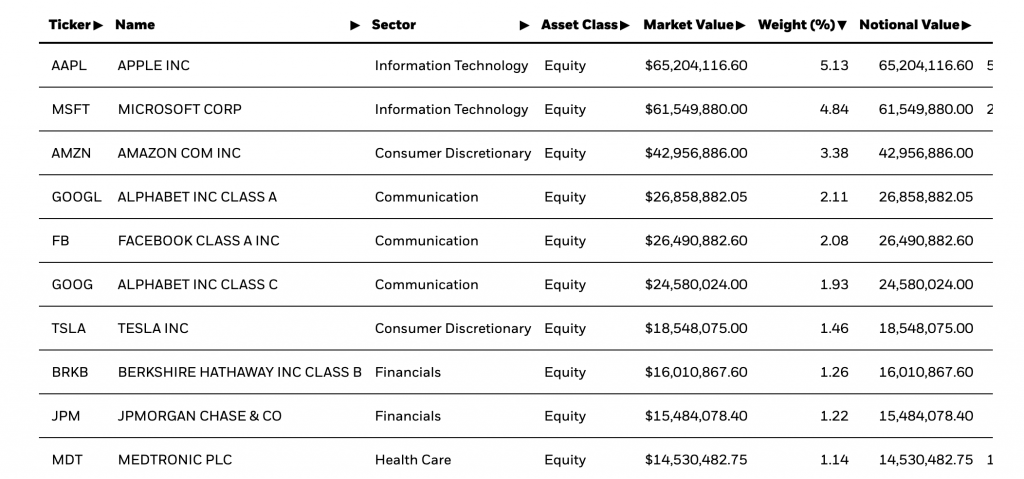

Take for example the Blackrock Carbon Transition Readiness ETF. Now, that sounds like the kind of thing you should be investing in right? Almost a no brainer in this environment. So you decide you can risk 10% of your portfolio into Carbon Transition Readiness companies. But take a look under the hood to see what you are buying. Here is the top ten holdings list for the Blackrock Carbon Transition Readiness ETF.

If you were looking for some breakthrough companies that have invented carbon capture, green hydrogen, solar panel or wind turbine manufacturers, energy storage, green metals, or some other activity directed at carbon reduction you would be sorely disappointed. The only company in the list that is remotely directly connected to the global carbon problem is the outrageously overvalued Tesla.

My point is, that ETF’s need just as much research and background checking as any managed fund. You can’t just look up a list of names, and pick something that ‘sounds’ right.

The Blackrock Carbon Transition Readiness ETF might just be the right thing for you if you are looking for large multi-national mega cap companies that are less likely to be affected by higher prices for emissions or stranded gas or coal assets. If that is what you are seeking, then it certainly does the job. Because when you buy the traditional market cap weighted ETF’s you will still have some exposure to big oil, and other higher carbon emitting companies.

But if you are looking for companies that will increase their profits directly as a result of new carbon technology, then you might want to pass this one by and keep searching.

The rise of ETF’s as an investing tool also has an impact on capital formation for companies involved in new technologies. I will talk more about that in a future blog as well as discussing how capital flows that are price agnostic are impacting on valuations.

Thanks for info Mark. As you are aware I have investments in a number of ETFs to have some diversification within my portfolio. I am however concerned with the ETFs in that you are provided with some of the “known” securities within the ETF however there is no indication of the quantity of each, does this vary with time?

What was the purchase price? What is actually being done for the management fee, other than the distribution of dividends. As an easy investment option of basically set and forget, they can also suffer greatly in the event of any market collapse. There are always fewer buyers for ETFs. On the plus, the prices continue to climb and they appear reasonably stable due to the diverse range of larger cap securities. It is probably the only easy way for many investors to have some shareholding of Apple, Microsoft, Tesla, etc. I have done some recent research and have an interest in new technology, particularly involving Graphene, Lithium, and Cobalt. Many of these businesses however are not yet providing profits, so difficult to address P/E’s, intrinsic valuations etc.

Thanks for the reply Chris. You can find out more about what shares are in an ETF by reading the monthly fact sheet, or ‘tear sheet’ as they are called in the US. These normally show the top ten holdings at least, as well as good info on how the portfolio is constructed. Purchase price is generally unknown. Yes, ETF’s are a great way to get exposure to the US markets and most foreign markets. As well as factors and sectors. And looking through the holdings list, then doing some research on each underlying company is also often a source of good leads in the particular sector.