Share markets, as represented by the broad indices, did very well in 2021. The ASX200 gained a total of 17.23% while the S&P500 gained 26.89%. The highest point for the ASX200 index in 2021 was 7628 points on Friday the 13th of August. It was not far off that level in early January at 7589 points.

However the first few weeks of 2022 have seen markets reversing course. The speed of the sell-off is raising a few questions about how markets will fare in 2022.

Some of the market results since peak prices are:

Nasdaq -12.88%

S&P 500 -8.20%

ASX200 -5.5%

What is worth noting, is that the sell-off has been concentrated in the so-called ‘Growth’ segment of the market – the stocks with above average Price/Earnings ratios and low dividend yields.

The Australian market with a high proportion of ‘Value’ stocks has been less effected but is still down a bit.

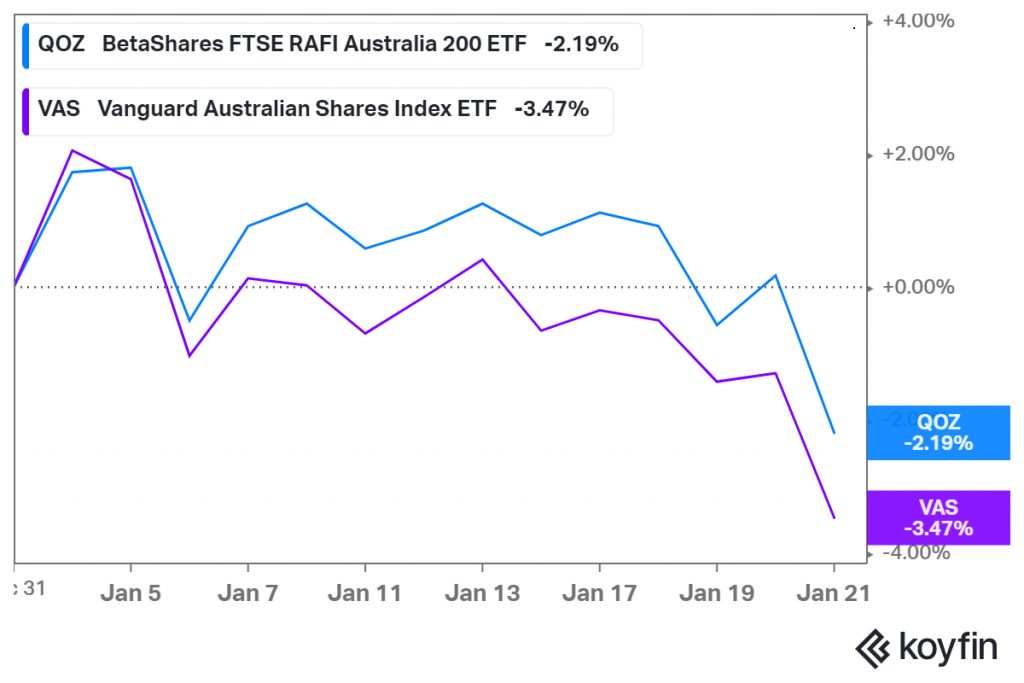

Readers of my November 4th article about ETF’s will recall my discussion of ‘factors’ within ETF’s where I referenced the QOZ ETF, which uses a Multi Factor filter to weight the portfolio towards stocks with more certainty of income, lower P/E ratios, and better dividends. In the chart below, you can see how this has protected portfolios to a small extent, with QOZ falling only 2.19% since 31 December, compared to VAS (Vanguard Australian Shares) down 3.47% in the same time frame.

An example of the ‘growth’ stocks that dragged the standard cap weighted index down was Afterpay. That stock, which had been a market darling, is down 44% since the start of 2021.

Although Afterpay was the Australian posterchild for overpriced, overhyped growth, the US market has hundreds of companies like that.

The unravelling of the US ‘growth’ factor is epitomized by the ARK Innovation fund, managed by Cathie Wood. The ARK fund itself is down 51.12% overall, but some of the companies in the portfolio like Berkley Lights (-88.82%) are approaching Dot-Com level wipeouts. Robinhood, the broking outfit that shot to fame with millennial day traders, is down 82%.

The Australian ETF launched by Betashares to track companies involved in the Crypto space is down 46.83% since launch date only two and a half months ago. One of the holdings in that ETF is Coinbase. Coinbase insiders (directors and executives) have sold $5.8 billion of their shares in the last year, and have bought $0 of shares. That tells you something big about the company.

Our abundance of caution has kept us away from all those blow-ups. The lesson is that at times when markets are crazy, you need to be willing to underperform for a while so as to keep your capital intact and have less downside if and when the bear market comes.

Will there be a Bear Market?

There is never a shortage of ‘bear porn’. That is; attention seeking headlines that are calling for the next huge wipeout in assets and an unravelling of the financial system. I am a follower of some of those channels. They do serve a purpose in counterbalancing the constant bullishness of fund managers and economists, none of whom ever forecast a recession until well after the fact.

The fact is that most bear porn is never noticed during an upmarket. It is only when a downturn hits that the less pragmatic of clients will send an article saying, ‘how did you not see this and get us out of shares altogether’? The fact is there are always risks, and volatility is the price of a ticket to the game where returns should beat inflation over time.

That said, how do we see this market sell-off, and what might the 2022 year hold for us?

The 2022 outlook

There is strong consensus that there will be at least 4 rate hikes from the US Federal Reserve this year. The price of money in US dollars has a big impact on global capital allocations. The four rate hikes are the ‘consensus’ view and therefore fully expected by the markets.

Rate hikes, while a headwind, are not by themselves fatal to a bull market.

In the table below are the years since 1978 when there have been 4 or more Fed rate hikes, and then the S&P500 return.

Coming off the back of a very good 2021 it is hard to imagine a double-digit return, but the prior events show that there is not necessarily going to be a wipeout.

What is more of a concern are the high Price to Earnings multiples, which in our view have to be ‘normalised’ at some time. If the wind comes out slowly, and if inflation does show evidence of slowing soon, then the market may be able to find a footing somewhere near the 10% sell off level that is the usual annual occurrence.

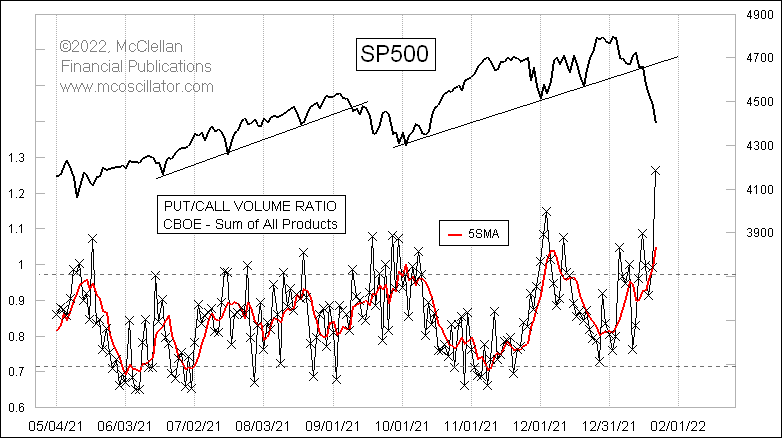

Looking at the short term, the Put/Call ratio is near a peak that often coincides with a low point in the market.

Tom McLellan’s excellent website provides this chart below.

It shows that whenever the ratio of put option purchases (hedging against a downturn) is equal to call option purchases, then there is often a significant low nearby.

One other indicator we watch is the credit spreads. Broad US sub investment grade credit is still trading on lower spreads (implying less risk) than the month of December. Investment grade spreads have increased slightly from around 0.90% above Treasury yields to about 1.00% above Treasury yields.

So we don’t see any fear in the corporate debt markets at this point.

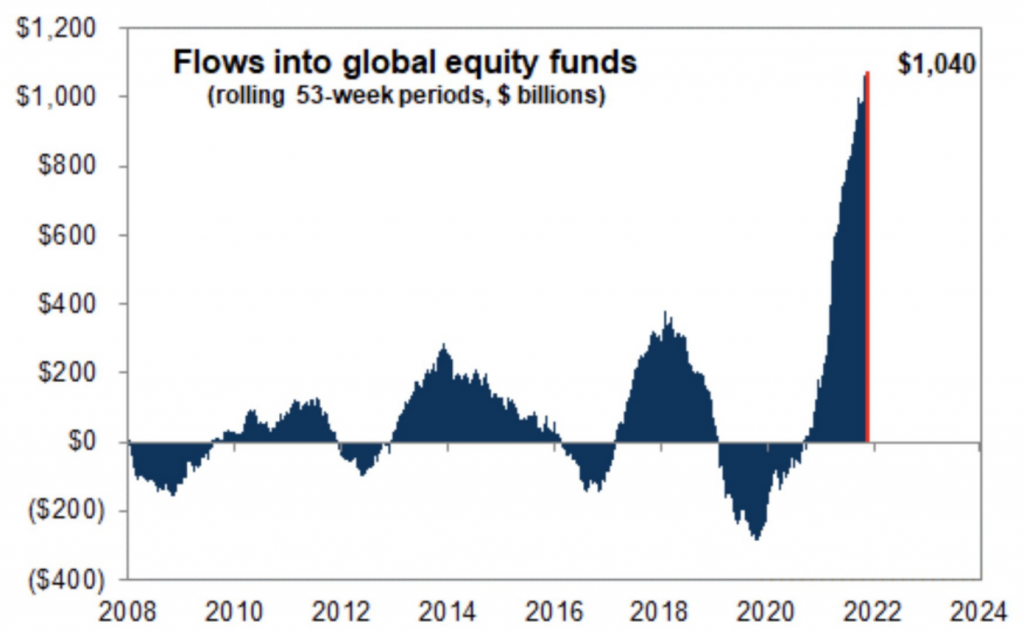

Another determinant of equity market performance is flows.

2021 was characterized by flows into equities that were above average as shown in the chart below from Goldman Sachs.

If we were to see a more normal pattern of equity investment flows, then it would be reasonable to expect some more downside.

Conclusion

We remain cautious and skeptical about the prospects for so called ‘growth’ stocks that are still by many measures expensive and likely to fall further in the rising interest rate environment.

Other indicators, like the put/call ratio, and the extreme readings in fear/greed indexes say that maybe there is a low about to be made, with a possible bounce to follow.

Picking a turn in the markets is a lot harder in practice than theory, and that is why we need to focus on owning good quality, fairly valued assets.

Additional protection also comes from ensuring appropriate investment time frames, and including low risk assets in a portfolio to fund any expected short term cash withdrawal requirements.