In the world of finance, the relationship between the Official Cash Rate and bond yields typically follows a predictable pattern: when the RBA or the Federal Reserve cuts interest rates, bond yields tend to fall.

However, recent events have presented a fascinating anomaly. On the 19th of September, the US Federal Reserve cut their target Fed Funds rate by 0.50%. The half a percent rate cut was a big signal that the rate cutting cycle was starting in earnest.

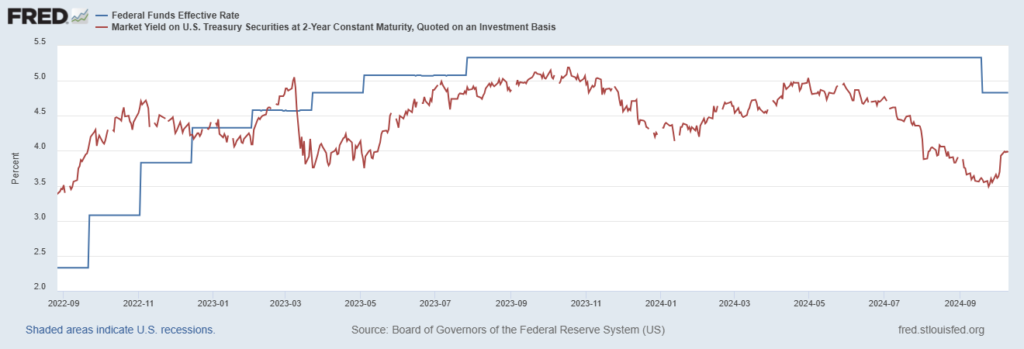

The bond markets and futures prices had been anticipating a cut for sometime. The US 2-year bond yield fell from 5.00% back in April, to 3.61% in the days before the Fed rate cut.

In the days following the rate cut, the 2 year bond fell to 3.49%.

Then a weird thing happened.

The US 2 year bond yield went back up to 4.03%. That is an increase in yield of over 0.50% the same amount that the Fed cut rates by.

So what’s the big deal?

It could be a bit of old fashioned ‘front-running’ in other words, ‘buy the rumour, sell the fact’.

But it could also be giving us some other important signals.

Inflation Concerns: It could be that investors think the Fed has cut too early, and are increasingly worried about rising inflation. If investors believe inflation will erode the purchasing power of future bond payments, they demand higher yields as compensation, even if the official cash rate is being pushed lower.

Economic Resilience: The economy still has some signs of strength. Although un-employment has started to rise, the September jobs report in the US showed a gain of 254,000 jobs, a number that surprised markets. This resilience can lead investors to anticipate that the Fed may not need to cut rates much further, or that the cuts may be temporary, prompting an increase in short-term yields.

Could this be the rare ‘soft landing’ that many are hoping for?

The Credit Markets seem to think so.

At present the yield premium demanded by investors to buy bonds issued by anyone other than the government is pretty tight. (also referred to as the ‘credit spread’) For example, in the chart below, the average BBB rates corporate bond in America trades at just a 1.07% higher yield than an equivalent government bond. This time last year that premium was 1.63% higher.

So the bond market is not sniffing out any kind of stress in the economy.

What about Equity Markets?

In the chart below we have the performance over the last 12 months of the S&P500, the Japanese Nikkei index, and the ASX All Ords.

They are all at or near all time highs, again, with no hint of fear of a recession.

At present the trend is up for equities.

What about commodities? Gold has been a big beneficiary of the anticipated rate cutting cycle. A strong dollar and increasing rates are generally the enemy of gold. But those twin headwinds now look like they are easing and gold is up 42% in USD terms over the last year.

The more industrial commodities have not chased as hard, and we show in the next chart, Coal, Copper and Steel.

“Dr Copper” as the red metal is often termed, has a history of being the most sensitive to the economic cycle. The one year gain on copper is +22%.

To sum up, we are not seeing a collapse in commodities that would indicate an imminent recession.

For those remaining in the bull camp, with a soft landing, equities and relatively short term credit are your go-to allocations.

For some insurance against a recession, high grade – longer term bonds, and some gold would provide some good diversifying assets right now.