It was a great financial year for markets.

Although things looked a bit shaky in September and October 2023 it was in early November that the markets perked up, and aside from a little hiccup in April, continued higher almost every month.

In fact, the US market has gone 351 trading days (as at 17 July 2024) without a one-day drop of more than 2%. That is the longest run since the period just prior to the GFC!

The catalyst for the November 2023 turnaround came as the Federal Open Markets Committee hinted that they had done enough tightening and acknowledged that the effects of previous interest rate hikes were still feeding into the system.

Twelve Month Returns to 30 June 2024

ASX 200 Accumulation +12.10%

Small Ordinaries +9.34%

Global Equities +19.80%

S&P500 Index (USD) +22.70%

A-REIT’s Listed Property +23.79%

Ausbond Composite Bonds +3.68%

Bloomberg Global Bonds (AUD) +2.67%

Winners

The best segment in Australia was Banks. The financials index was up 29.2%. Info Tech was up 28.4%, and Listed Property was up 24.7%. The return on bank stocks was unexpected by most, and has resulted in the most extreme valuations on Australian Banks that I recall in my 34 years in this business. Loyal Commonwealth Bank shareholders are the winners so far; valuation sensitive analysts are the losers!

Globally it was a narrow sliver of the market which has become known as the Magnificent Seven, where the biggest gains were found. Nvidia was the big winner as AI became the buzzword of the year.

Losers

Lithium and Rare Earth companies. With Lithium Spodumene prices down about 90% from peak this segment took a bath. The ACDC ETF that invests in global Battery Tech and Lithium was down 14.70%, though many companies took a bigger hit with Pilbara Minerals down 35%, and Mineral Resources down 23.5%. Other smaller lithium hopefuls are down a lot more than that.

Market Outlook – Valuations

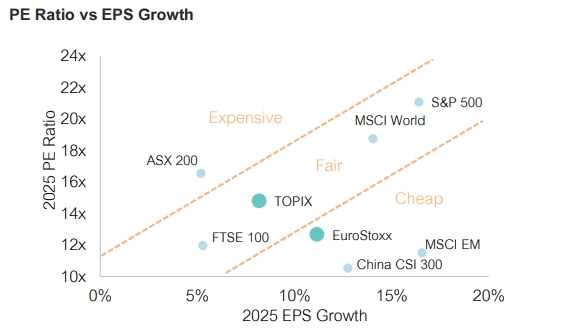

In the table below we present a cross section of broad market Price to Earnings ratios, versus the expected next twelve months earnings Growth.

The point is that it’s OK to pay a higher Price for a company or broad market, if the expectation is that the earnings will grow faster than other markets.

According to Lonsec, Australian shares fall into the Expensive category right now, as earnings are expected to grow only 5% in the next twelve months. The MSCI and S&P500 (global stocks) are in the Fair Value area, only because earnings are expected to grow more quickly than Australian company earnings.

The Cheap areas appear to be Europe, China and Emerging Markets all trading below 13x earnings and with earnings growth prospects of 10% plus.

Of course, the value of this kind of chart for decision making all depends on the ability of analysts to accurately forecast the future.

Macro Factors

Macro Events can derail the best of analysts forecasts. Most forward earnings forecasts come from the ‘bottom-up’ views of individual company analysts. These in turn are somewhat coloured by the discussions with management. It is also true that Economists never forecast recessions. So we don’t look to them for guidance. On the other hand, YouTube gurus and newsletter sellers also often use doom and gloom to attract an audience.

In my experience it pays to have a healthy scepticism of both ends of the spectrum.

At present there are signs of cracks in the economy. While Australia added 50,200 jobs in June, the pace of immigration and increased participation rate meant that the un-employment rate went up to 4.1%. Australia is already in a GDP per Capital recession.

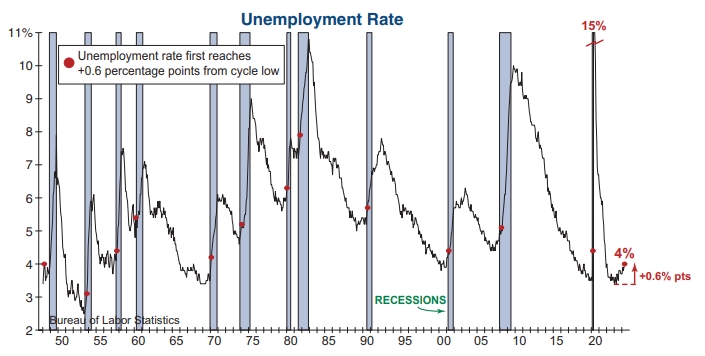

In the US, the unemployment rate is at 4.0%. Low by historical standards, but it is up 0.6% off the lows. It is worth noting that since 1948, whenever the unemployment rate has ticked up by more than 0.6 of a percent, a recession has followed.

A softer economy usually allows the Central Banks to ease interest rates, which is good for most financial assets. Except when we go into a recession. Then all kinds of things can break, and ‘fair value’ discussions are replaced by ‘get me outa this’ panic.

It seems that the markets have been ‘front running’ the easing interest rates, without any concern that we could be walking into a recession. While it has meant great returns, most share markets are now into territory that can’t be described as cheap.

Interest rates

Most commentators are predicting a rate cut by the US Federal Reserve when they meet on 18 September. The odds are 88% at present.

Here in Australia, there is still a 28% chance of a rate hike in September.

But rate cuts don’t guarantee higher markets when they are in conjunction with a recession. In 2007 the US Fed started cutting rates and the market still fell 58%. In 2000 when the Tech Bubble peaked, rates were cut but markets fell 51%.

As can be seen above, longer term bonds are factoring in more of a possibility of a rate cut in US markets than Australia, even though the nominal level of Australian rates are currently lower.

Technical Factors

If everyone is buying, your fundamental valuations mean nothing. That seems to be the case at present. A lot of money has flooded into the Tech and AI segments of the market. In some cases for good reason. Many of the tech companies are relatively immune to higher rates of interest, at least from a profitability perspective.

In Australia, we need to take into account the flood of money that comes into our market from compulsory superannuation. Each month, 11% of the salary of every worker finds its way into markets, and even if only 25% of that was into Australian equities, that is still a big tailwind.

Through much of last year the leadership in US stocks was very ‘narrow’. We spoke about the Magnificent Seven, which did most of the heavy lifting. During June, while the S&P500 was hitting new highs, the number of stocks hitting 52 week lows was greater than the number hitting 52 week highs. This has only ever happened 7 times in the 96 year history of the S&P500.

However, on July the 10th, a strange thing happened. The Russell 2000 index, which up to that point had underperformed the S&P500 by 18%, suddenly had a change of speed. Since then, the Nasdaq is down 4.21%, while the Russell is up by 9.28%, a performance difference of 13.5% in a matter of a week.

Will there be a catchup now, where small and mid cap companies and value stocks catch a bid, while the Mag Seven take a rest? Who knows, but it is certainly helping our preferred exposures right now.

Politics

The events of last weekend, with the attempted assassination of Trump, seem to have swung the odds towards Trump having another term in the big house. His running mate JD Vance has been described as a Trump clone, and their politics and policies seem to be very aligned.

What would a Trump presidency mean for markets?

For starters – let’s just bullet point some of the obvious leanings

- Antitrust measures – bad for Tech, Meta, Google,

- China Tariffs – bad for Importers, Walmart, Costco etc.

- NATO indifference – bad for the Industrial Military Complex

- ‘Taiwan can pay for their defence’ – bad for firms relying on plentiful chips

- Borrow and spend and damn the deficits – bad for the long end of the bond market

- Pressure to lower interest rates – good for gold

- Weakening USD – good for gold and commodities, good for exporters

- Drill Baby, Drill – Good for oil and gas explorers and pipeline operators

- Crack down on Illegal Immigration – good for private detention centre operators

The good thing is that we are not new to this situation. What happened after 6 November 2016 I hear you ask!

In the first week after the surprise Trump election result, Financial stocks were up 11.2%, Industrial stocks were up 8.11%, while Utilities stocks were down 4.00%. Fast forward three months later, and Financials were up 22.2%, Industrials up 13.35% and Tech was up 10.2%. Utilities remained the laggard, with a return of 2.97%

Twelve months later, in November 2017 Financial stocks were up 39.6%, but Tech had raced ahead to top the sectors at +39.7% Energy was the laggard at +4.56%, and Consumer Staples gained 5.74%

It is hard to pick distinct winners with a high level of certainty. Yes, we can get a bit of a read on where the headwinds and tailwinds are going to be, but the fundamentals of a company or a sector can outrun political interferences.

We will keep these Macro, Technical and Political factors in mind as we trim our portfolio sails to catch the more favourable winds.