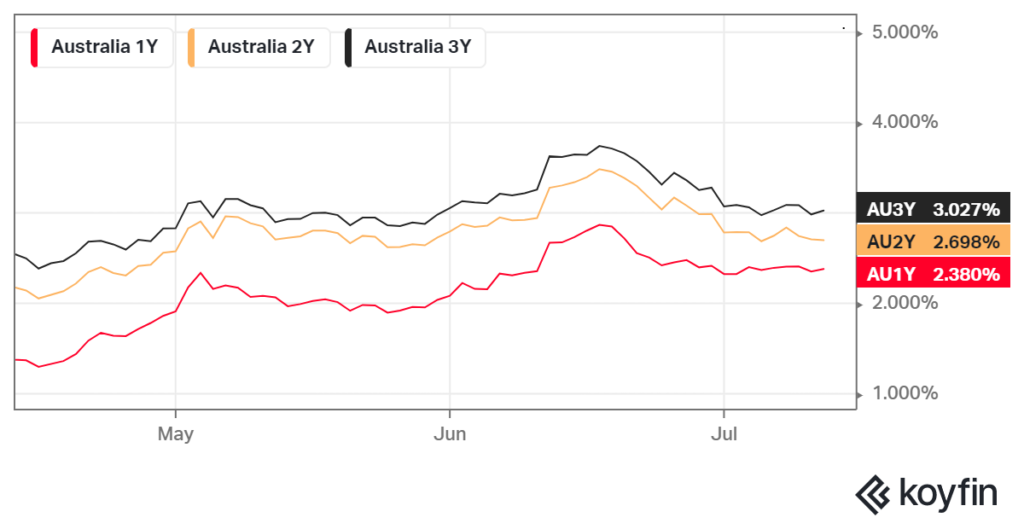

Just in case you think I’ve gone batty, I have the charts to prove it!

When all the world is talking about rates rising, the mysterious bond market is doing its own thing.

Interest rates on government bonds with maturities beyond one year have actually been coming down.

It all started happening in a window around mid June.

The 3 year Australian government bond hit 3.74% on 17 June, and has since fallen to 3.02%

Even the one year government bond which was at 2.88% in June, is now down to a 2.38% yield, a fall of 0.50%.

This happened at the same time that the RBA lifted the Cash rate in Australia by 0.50% to 1.35%!

In that short space of time, the Vanguard Australian Government Bond ETF went up by 4.77%.

Bonds rise in value as interest rates fall, and conversely fall in value as interest rates rise. Imagine you have loaned money for 10 years at fixed interest rate of 5% per annum. If the market rates of interest for 10 year loans rise to say 6%, then the present value of your ten years of income at 5% has just fallen. As a rough guide, a 1% rise in interest rates means a 1% fall in bond price for every year until maturity. Here is the actual price formula: ∑ (Cn / (1+YTM)n)+ P / (1+i)n

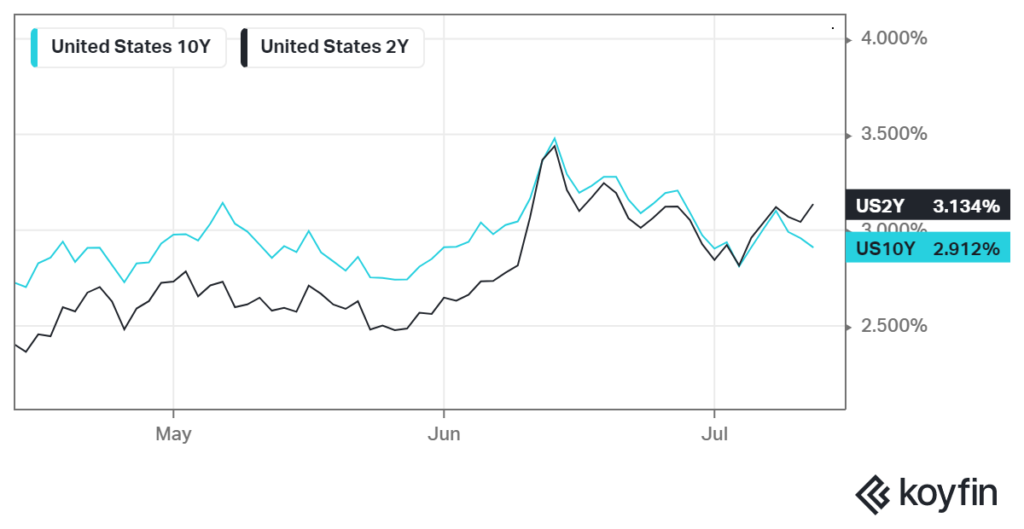

The same phenomenon has also been happening in the USA. The chart below is the 2 year and 10 year bond yields. The 10 year peaked at 3.5% on 14 June, and since has fallen to 2.91%.

The fact that the 2 year bond yield is now higher than the 10 year bond yield also points to a recession. This is what they call an ‘inverse yield curve’ – google it!

There is no doubt that the Federal Reserve will keep on pushing up the official target rate. But the bond market is screaming ‘I give’.

While in the short term, equity markets are getting a bit of a breather from these lower bond rates, in the 12 to 18 month time frame, an ‘inverse yield curve’ is almost always a precursor to recession. With recessions come profit downgrades, and we may see that cycle starting soon with the upcoming reporting season.

When will the central banks hear the bond market plea’s for help? Not any time soon, because they can only hear the screaming of inflation rocket boosters at the moment and they seem to think households are in great shape financially.

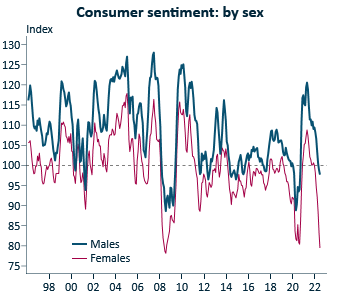

That is not what consumers themselves are saying. The chart below shows consumer sentiment readings.

Consumers clearly don’t feel like they are in great shape, and women feel worse than men, mostly because they are more likely to do the household grocery shopping!

The Eurodollar futures contract is a gauge of what future interest rates on US Dollar deposits with offshore banks might be in the future.

The contract for December 2022 is implying a 4.03% interest rate on a 3 month deposit, while the contract for a 3 month deposit starting in June 2023 is implying a 3.55% rate. The Eurodollar market is forecasting that official rates will drop by 0.50% between December 2022 and June 2023.

Turning to the Australian futures market, the Bank Bill futures for December 2022 were pricing in a year end rate of 3.79% back on 14 June. Today, (14 July) that same contract is pricing a 3.28% rate. So those expectations have also been wound back by around 0.50%.

Make no mistake though, Central Banks like the RBA and the Federal Reserve are still in a rate hiking cycle, and those rate rises are also likely to come in half or three quarters of a percent jumps.

However, in spite of the record-setting 9.1% annual CPI rate just announced in the US last night, the bond and futures markets are starting to look to the ‘other side’ and are now expecting possible rate cuts in early 2023.

I’m not promising that it will continue, just making the observation of a widespread change of direction in the bond market. If you have been negotiating a fixed rate home loan recently, this move is also worth taking into consideration. Also, if you are locking in term deposit rates, don’t wait, we may have already seen the best rates.

Stay safe and diversify!

Very very interesting!