October ended the month with a three day streak where yields on short term bonds were shot out of a cannon. It was a test of the resolve of the Reserve Bank of Australia to keep short term rates pinned at around 0.10%. One of our more savvy fixed income fund managers was asked the question, ‘is the RBA abandoning its target of a 0.10% three year bond yield?’

The answer came back, “No I wouldn’t assume they have abandoned the target just from the price action. In fact we have already seen a similar episode where the yield target slipped quite a bit, going back a few months ago when the market was debating whether they would extend the April 2024 target to the November 2024 bond.

So what we learned from this prior episode is that the RBA is quite happy for market yields to diverge from the target for short periods, and potentially even a few weeks, but if it goes beyond that, then they tend to come in and do more buying to tidy it up.”

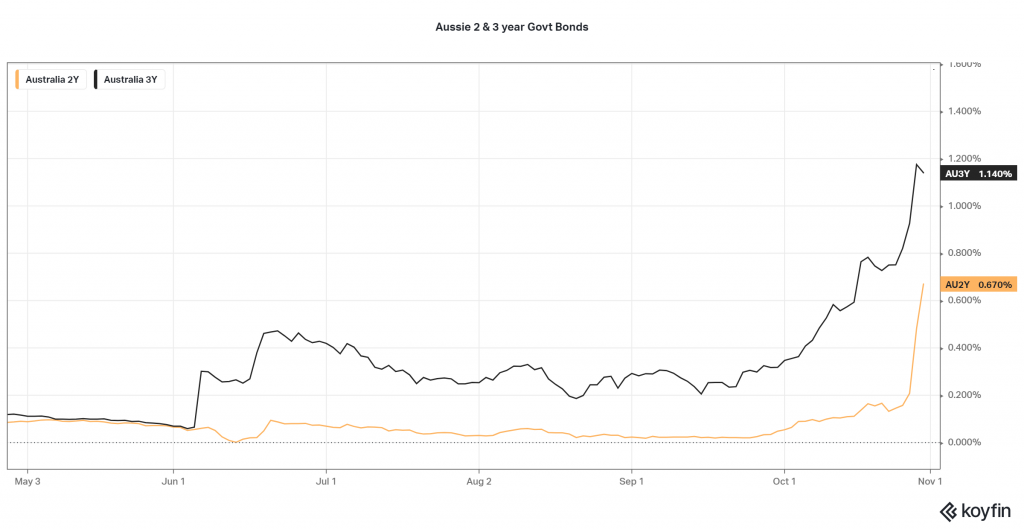

Given the ruckus this week, it is clear that the RBA will have plenty to discuss in their meeting on Tuesday 2nd of November. The April 2024 Government bond is well above their target of 0.10%. To give some perspective on the interest rate move, we have included a chart of the two and three year government bonds.

As you can see, the three year bond has been rising in yield all month, with almost a 60 basis points gap between the two on 19 October. Then in the final three days, the two year bond shot up to partially close the gap, but still leaving a fairly wide spread.

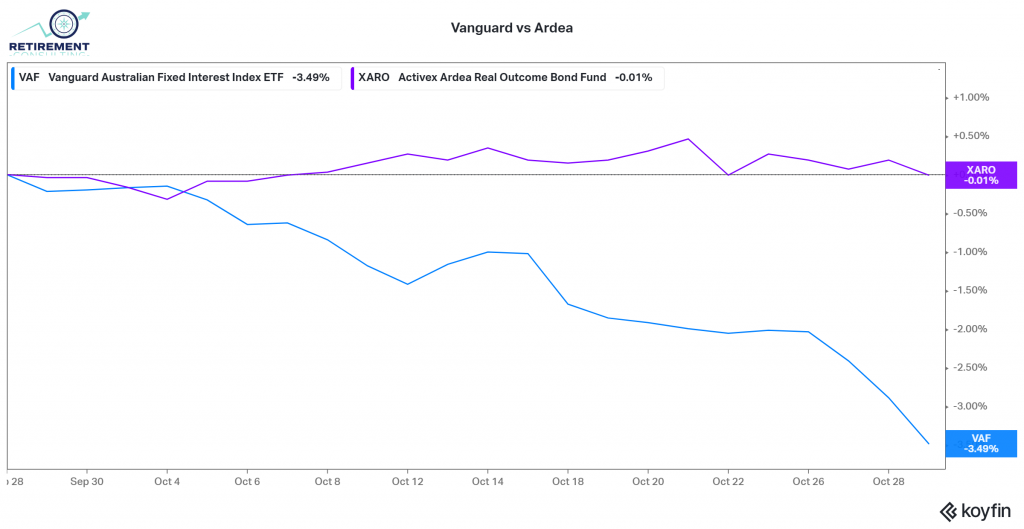

What effect did the month have on traditional fixed income funds? The best proxy we have for that is the Vanguard Australian Fixed Income Fund ETF.

The VAF ETF return was -3.49% over the month. For comparison, we also include one of the Active Fixed Income funds we use in portfolios, the Ardea Real Outcome Fund, which rode through the carnage with a loss of only -0.01%.

Once all of the monthly reports are out we will see who had longer duration their portfolios. Interestingly credit spreads have remained fairly constant, indicating no deterioration in the economic outlook for companies.

The fixed income funds we have invested in tend to have shorter duration, and the ability to trade around investment grade credit. Although these don’t do as well when rates are falling, they don’t get hurt so much by interest rates rising.

How does this play out in other asset classes?

On Friday the Financial Review ran an article written by Christpher Joye, suggesting that real estate could fall as much as 20% with only a 1.00% increase in interest rates. His article also suggested that the ‘neutral’ interest rate setting for the RBA might be at 1.00% to 1.50%. Add to that the fact that during October, APRA increased the mandated minimum interest rate buffer when assessing borrower’s ability to repay loans. New borrower’s will need to demonstrate an ability to withstand a 3.00% rise in interest rates. These two warning shots may be the signal that we are close to the top of this market cycle for residential property.

Equities were doing well this month, recovering from the -1.88% sell-off in September, shares were up 1.80% by Wednesday the 27th. However, over the last two days, coinciding with the bond market sell-off, the market fell sharply, and finished the month with a -0.12% return.

Will this interest rate rise de-rail the equity bull market? It certainly makes investors pause to consider the question, how high will rates go? If the RBA cash rate was to return to the post-GFC cycle highs of 4.75% it seems certain we would see equities down by 20% or more. However, my thinking is that this cycle will be much more muted, and possible an increase for the cash rate to 1.25% may be as far as it goes. That could still take two years if the RBA sticks to the original timeline.

At that rate we would possibly see a more typical 10% to 13% sell-off that is fairly standard fare every year. The hard part is knowing when that happens and how to manage it. We have tended to hold higher weightings to short term liquid assets, and while that is a drag on performance, it also allows us the luxury of not having to sell assets that have fallen in price so as to meet portfolio cashflow needs. It also provides cash to take advantage of good assets selling cheap.

Certain stocks in the Materials sector are already well down on their highs. BHP for example is down 27.99% from the highs back on August 4th. Yes, iron ore prices are down, but no-one expected $200 US dollar per tonne prices to last. BHP is still a very profitable company even at $100 per tonne for iron ore. Mineral Resources is another that has been sold off due to its iron ore exposure, yet it also has a very profitable stream of income emerging from Spodumene, an important component of Lithium. Gold miners are also trading on very attractive multiples even without an increase in gold prices.

Oddly enough, although we are headed into the COP26 conference this week, it is Big Oil that is winning at the moment. Over the last year, the exchange traded fund, FUEL, which invests into the largest global energy companies, is up 76.13% vs 25.55% for the broader Australian sharemarket. This month alone it is up 6.09% vs the broad market down -0.12%.

On the topic of climate change, which has been the only news item to get anywhere near the airplay of COVID, it is ironic what we see playing out right now. Let me be clear, I am all for reducing the carbon and overall pollutants that we as humans put into our atmosphere. But the chest beating western nations politicians and ‘woke’ bankers who are cutting off supply of capital to mining and energy will be the ones responsible for this emerging energy crisis. Yet they will at the same time have the temerity to point the finger at oil companies ‘profit gouging’ as oil and gas prices remain stubbornly high contributing to this bout of inflation. The ‘activist’ directors installed on the board of Exxon Mobil have the company re-thinking a number of new projects, including a $30 billion LNG development in Mozambique. If the directors of Exxon Mobil decide not to develop it, are we in the west so naïve to believe it will go un-developed and that gas will stay in the ground? To be sure, China or Russia will come along to scoop up that project and that gas will get to energy hungry countries one way or another. The current European energy crisis already has Vladimir Putin chuckling with glee as the Germans have almost no option but to approve Russia’s Nordstream II pipeline. Our western politicians in their embrace of ‘net Zero by 2050’ are handing the energy we still need during the next 30 years to the Russians and Chinese on a silver platter.

Back to the impacts of interest rate rises, we have previously commented that as risk free benchmark interest rates rise, the biggest price risk is on the longest term assets. A technology company whose current cashflows are way in the distant future are most at risk. We have previously been favouring Value over Growth, and in this market, those Value stocks, with their higher current cashflows, are likely to be less affected by this interest rate rise.

However, it will be a bumpy ride. Our expectation is that in the scheme of things, the rate rises will be modest. But as markets contemplate how high and how quickly rates could rise, there will be large swings in valuations. We need to have at least a five year plus holding period in mind for any share or property related assets to ameliorate the effects of the volatility that will come in this part of the cycle.