The 2023 Budget is out now, although most of the detail had been well telegraphed over the last few weeks. The forecast for the 2023 financial year is that the budget will be in a surplus position by around $4 billion. Bracket creep and a surprisingly robust employment base helped the budget into the black as individuals paid $14.4 billion more in tax than expected last October, along with higher than expected tax receipts from companies, up by $29.4 billion. The Petroleum Resource Rent Tax brought in $340 million more than expected.

Markets have been quite sanguine about the budget. As details leaked out over the last 10 days, the 3 year Aussie bond yields tracked from 3.07% to 3.12% in line with broader trends. Ten year bonds were steady around 3.47% since the Budget. Since the start of the month, the AUD/USD currency has appreciated by 2.28%, and the sharemarket is down slightly, but less than overseas markets, indicating the Budget was a big ‘nothing burger’ from a financial markets perspective.

Even with the expectation that the surplus will be short-lived, and we will be back to budget deficits of -1.3% of GDP in 2024/25 (expected deficit $35 billion) the markets are quite blasé about the forward path.

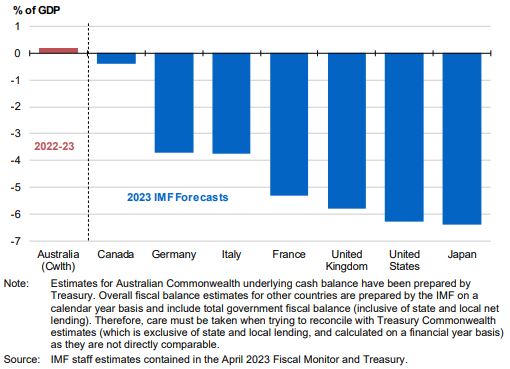

The likely reason why is found when we compare ourselves to other countries.

As you can see, even with boom times, the deficits are already running at more than 6% of GDP in the US and Japan. It seems we are still the Lucky Country, and while we may lament that we are lucky because we dig up dirt and sell it overseas, as Lefty Gomez of the New York Yankees said, “it’s better to be Lucky than Good!”. Lets get into some of the details.

Individuals

The Income support payment base rates will be increased by $40 per fortnight.

Additional 9,500 Home Care Packages released in the 2023/24 tax year.

The minimum age for which older people qualify for the higher JobSeeker Payment rate will be reduced from 60 to 55 years.

The workforce participation incentive measures to support pensioners who want to work without impacting their pension payments will be extended for another 6 months to 31 December 2023.

Eligibility for Parenting Payment (Single) will be extended to support single principal carers with a youngest child under 14 years of age.

Housing measures will be introduced to increase support for social and affordable housing and improve access for home buyers.

The maximum rates of the Commonwealth Rent Assistance (CRA) allowances will be increased by 15% to help address rental affordability challenges for CRA recipients.

CPI indexed Medicare levy low-income threshold amounts for singles, families, and seniors and pensioners for the 2022–23 year announced.

Eligible lump sum payments in arrears will be exempt from the Medicare levy from 1 July 2024.

Superannuation

There was nothing much announced here that we didn’t already know.

Confirmed that the superannuation earnings tax concessions will be reduced for individuals with total superannuation balances in excess of $3 million from 1 July 2025.

Employers will be required to pay their employees’ superannuation guarantee entitlements at the same time as they pay their salary and wages from 1 July 2026.

The non-arm’s length income (NALI) provisions will be amended to provide greater certainty to taxpayers.

Business

Currently small businesses are able to write off big ticket capital items immediately. Some concessions on this front has now been extended into the 2023/24 tax year.

The instant asset write-off threshold for small businesses applying the simplified depreciation rules will be $20,000 for the 2023–24 income year.

An additional 20% deduction will be available for small and medium business expenditure supporting electrification and energy efficiency.

FBT exemption for eligible plug-in hybrid electric cars will end from 1 April 2025, although existing arrangements entered into before 31 March 2025 will remain eligible.

An increased capital works deduction rate and reduced withholding on managed investment trust (MIT) payments will apply to new build-to-rent projects. The rate is 4.00% p.a. instead of the current 2.50% p.a. The withholding tax rate being reduced to 15% from 30% will also help the Build to Rent sector.

Summary

There was nothing in the budget that changes the financial and tax planning strategies that we already have in place.

In the next week or two we will do a checklist for the best pre-June 30 tax strategies.

Nice, to the point summary.